Bank reconciliation statement

- Definition and explanation

- Reasons of difference

- Steps in preparing a bank reconciliation statement

- Example

Definition and explanation:

Bank reconciliation statement is a statement that depositors prepare to find, explain and understand any differences between the balance in bank statement and the balance in their accounting records.

All transactions between depositor and bank are entered by both the parties in their records. These records may disagree due to various reasons and show different balances. The purpose of preparing a bank reconciliation statement is to find and understand the reasons of this difference in account balance.

Reasons of difference between bank records (bank statement) and depositor’s accounting record:

Usually, the balance on the monthly bank statement does not agree with the depositor’s accounting record. The usual reasons of this disagreement are listed and briefly explained below:

1. Outstanding/unpresented checks:

Outstanding checks (also known as unpresented checks or uncleared checks) are the checks that have been issued by the depositor in favor of a creditor but have not yet been presented for payment by him. The amount of these checks are recorded by the depositor when they are issued but no entry is made by the bank in his account until the checks are actually presented and payment received by the creditor. Unpresented checks, therefore, cause a difference between the balance in company’s accounting record and the balance as per bank statement for the period concerned.

Example:

You issued a check to Mr. X (one of your creditors) for $500 on January 31, 2021 and entered it immediately in your accounting records. Mr. X did not present or deposit that check in his account before the end of January. Your bank statement for the month of January would not show the entry for that $500 because Mr. X did not present this check before the end of January. It would essentially create a difference of $500 between the balance in your accounting records and the balance in the bank statement.

2. Deposit in transit:

Deposit in transit means the cash received from a party has been recorded by the depositor but has not been entered by the bank in the bank statement. It usually occurs on the last day of the month.

Example:

You received $800 from Mr. Y (one of your debtors) on January 31, 2021 and recorded it immediately in your accounting records. You then sent this cash to your bank to be deposited into your account but it reached too late to be entered in your bank statement for the month of January. The balance in your accounting record would be different from your bank statement.

3. Credit entries for interest earned:

Banks pay interest on some accounts. If this interest is credited in the depositor’s account without intimating to depositor, the bank statement and the depositor’s record would not agree.

4. Service charges deducted by bank:

Banks provide various services to its customers and deduct service charges from their accounts. The depositors usually are not aware of such deductions. These charges create a difference of balance between bank statement and the balance as per depositor’s record.

5. NSF Check:

NSF stands for Not Sufficient Funds. When a customer deposits a check in his account, the bank immediately credits his account with the amount of the check deposited. Sometime such checks are not honored because the person issuing the check does not have sufficient funds in his account. In such situation, bank reverses the entry and reduces the balance of depositor’s account to previous amount. The dishonored check is then returned to the depositor as NSF check.

Example:

You received a check from Mr. A for $1,000. You entered it immediately in your accounting records and deposited the the check into your account. After depositing the check, your bank immediately credited your account by $1000. Afterward your bank told you that Mr. X’s bank did not honor the check because there were not sufficient funds in his account. Your bank reduced your account by $1,000 and returned the dishonored check of $1,000 to you as NSF check. The balance shown by your accounting record will differ from your bank statement by $1,000.

Steps in preparing a bank reconciliation statement:

Step 1 – Find the deposits in transit:

The first step is to see if one or more deposits are in transit. You can do so by comparing the deposits in your accounting record with the deposits shown by your bank statement. If you find a deposit in your accounting record that does not appear in bank statement, it means that particular deposit is still in transit and has not been credited to you account by the bank.

Treatment:

Add to the bank statement balance all deposits that are shown by your accounting record but have not been entered in the bank statement.

Step 2 – Find outstanding/unpresented checks and deduct from bank statement balance:

Find all checks that you have issued but have not been presented for payment. You can do so by comparing the checks issued in your accounting record with the checks honored as per your bank statement. If your accounting record shows that a check has been issued and your bank statement does not show a corresponding entry for that check, it means that it is an outstanding or unpresented check.

Treatment:

Deduct from the bank statement balance the proceeds of any check that you have issued and entered in your accounting record but have not been presented to paid by the bank.

Step 3 – Find and add credit memorandum to your accounting record:

Bank issues a credit memorandum when it collects a note receivable on behalf of the depositor. Find if there exists any credit memorandum issued by the bank that you have not entered in your accounting record.

Treatment:

Add to your accounting record any credit memorandum, that you have not already entered.

Step 4 – Find and deduct debit memorandum from your accounting record:

Bank provides various services to its depositors such as printing checks, processing NSF checks and collecting notes receivables etc. Bank usually deducts charges from depositor’s account for such services and intimates him or her about these deductions by issuing a debit memorandum. Find if there exists any debit memorandum that have not been recorded in your accounting record.

Treatment:

Deduct from your accounting record any debit memorandum issued by the bank but not entered in your accounting record.

Step 5 – Are the adjusted balances equal?

See whether adjusted balance of your accounting record is equal to the adjusted balance in your bank statement.

Step 6 – Make appropriate journal entries:

The final step of a bank reconciliation process is to prepare appropriate journal entries for the items that are causing the difference because you have not yet recorded them in your accounting record.

For better a explanation and understanding of how a bank reconciliation statement is prepared, consider the following example:

Example

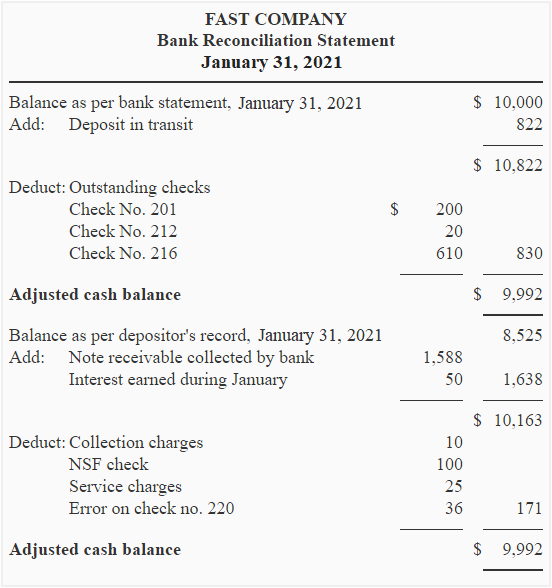

The bank statement of the Fast Company shows a balance of $10,000 on January 31, 2021 whereas the company’s ledger shows a balance of $8,525. The following reasons have been identified for this discrepancy.

- An amount of $822 sent to the bank for deposit on January 31, 2021 does not appear in the bank statement.

- The following checks issued during the month of January have not yet been cleared by the bank.

Check No: 201, Issue date: 15 January 2021, Amount; $200;

Check No: 212, Issue date: 19 January 2021, Amount; $20;

Check No: 216, Issue date: 25 January 2021, Amount; $610; - A note receivable amounting to $1,588 has been collected by bank for the company.

- The bank statement shows that interest amounting to $50 has been earned on average account balance during January.

- The bank has charged $10 for the collection of a note.

- A check of $100 deposited by the company has been charged back as NSF.

- An amount of $25 has been deducted by bank as service charges for the month of January.

- The check no. 220 is issued to electricity company. The check is in the amount of $95 but is erroneously recorded in the cash payments journal as $59. The credit entry in the journal is, therefore, understated by $36 (= $95 – $59)

Required: Prepare a bank reconciliation statement for the Fast Company using above information. Also make journal entries to update the accounting records of the company.

Solution

(a). Bank reconciliation statement

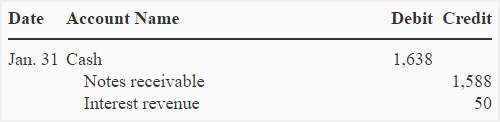

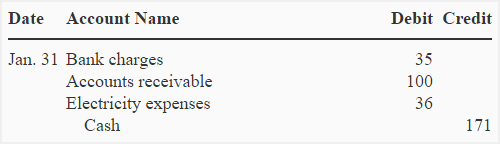

(b). Journal entries to update company’s accounting record

To record cash receipts:

To record cash payments:

Note: We have made two journal entries to update the accounting records of Fast company – one for cash receipts and one for cash payments. Alternatively, separate journal entries for each item or only one compound entry can be made to update the accounting record of the depositor.

It was helpful

great example