Customer advances and deposits

Companies may require their customers to deposit a specific amount of returnable funds as guarantee to cover the payment against an obligation expected to arise in future or to guarantee the performance of a service or contract.

Wireless communication companies like Alltel, Office Sense and Ring Savvy often ask their customers to deposit on hardware like routers and other equipment used to access internet and other services. They may also require customers to deposit funds as guarantees against possible damage to their properties. Some companies receive deposits from employees for the return of their properties.

For balance sheet purpose, such advances and deposits are categorized as current or non-current liabilities depending on the time between the date on which the deposit is made and the date on which the relationship requiring such deposit ends.

Journal entry for customer deposits

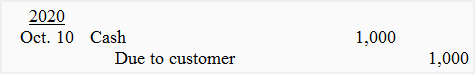

Customer deposits are journalized by debiting cash account and crediting customer deposits or due to customer account. The journal entry is given below:

Cash a/c [Debit]

Customer deposit/due to customer a/c [Credit]

Example

On October 10, 2020, Abraham Departmental Store receives $1,000 from Kims’ Players as deposit for certain lights, carpets and furniture to be used in a live stage performance. The Kims will return all the items to the store on October 15, 2020.

Required: How would you journalize the above deposit to create a liability in the books of Abraham Departmental Store on October 10, 2020?

Solution

Leave a comment