Average unit cost method of joint cost allocation

Under average unit cost method, as the name implies, an average unit cost is calculated and used to apportion a joint production cost among all the joint products. The average unit cost is calculated by dividing the total joint production cost incurred by the total number of units of joint products produced.

The average unit cost method is very simple to employ for allocating a joint production cost to joint products because it considers all the joint products as the same units. However, the method is viable only for those production processes in which the difference between the joint products is very small. If a process produces joint products that substantially differ from each other, the average unit cost method would not be a suitable option for the allocation of joint costs.

Consider the following examples for further understanding of average unit cost method method:

Example 1

Stella’s Bakery & Confectioners, is a local bakery that specializes in baking a variety of delicious biscuits and cookies. The main dough used for baking all the biscuits and cookies is the same. After the preliminary preparation and baking of the dough, the biscuits and cookies are treated with different kinds of ingredients based on the flavor the bakery wants. This may depend upon the customers’ demand the biscuits and cookies. So, this stage can be called as split off point and after this point all the different kinds of biscuits will incur individual costs.

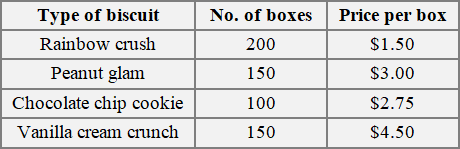

For a recently completed batch of biscuits, Stella’s ran a joint baking batch as follows:

The total joint cost for the preliminary baking session are $1,200.

Required: Allocate the joint cost among all types of biscuits using average unit cost method.

Solution

Step 1 – Computation of average cost per unit:

Average cost per unit = Total joint cost/Total number of units produced

= $1,200/(200 units + 150 units + 100 units + 150 units)

= $1,200/600 units

= $2.00 per box

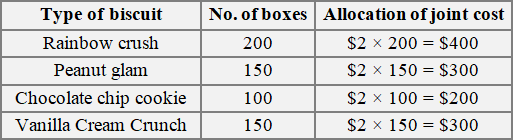

Step 2 – Allocation of joint cost:

This above allocation of cost is only the joint cost till the split-off point. After split-off point, any ingredients to be added to the biscuits would be allocated individually to each type of biscuits.

Example 2

Rajesh Stationary Brothers Ltd. is a family owned company that manufactures stationary items. The main item that Rajesh Stationary Brothers Ltd. manufactures is pens of different colors. The initial process of manufacturing the body of pens is almost the same. The inks of different colors cost different and this cost is allocated to the individual cost cards of pens depending upon the demand.

The Rajesh Stationary Brother Ltd. runs a joint production batch of producing a total of 1,000,000 pens as follows:

- Blue ink pens: 200,000 units

- Red ink pens: 500,000 units

- Green ink pens: 300,000 units

The total joint cost of the batch up to split-off point is $400,000.

Required: Allocate the joint cost among all types of pens produced using average unit cost method.

Solution

Step 1 – Computation of average cost per unit:

Average cost per unit = Total joint cost/Total number of units produced

= $400,000/1,000,000 units

= $1,200/600 units

= $0.4 per pen

Step 2 – Allocation of joint cost:

- Blue ink pen: $200,000 × 0.4 = $80,000

- Red ink pen: $500,000 × 0.4 = $200,000

- Green ink pen: $300,000 × 0.4 = $120,000

This cost allocation is of the manufacturing of body of pens which is the split off point. After this, individual cost would be apportioned to different pens based on the ink injected in them.

Leave a comment