Quantitative or physical units method of joint cost allocation

Under quantitative unit method (also known as physical unit method), the joint cost is allocated among joint products on the basis of measurement units like tons, gallons, pounds or feet etc.

To use this method, all the joint products must be measurable by some basic unit of measurement. In situations where such measurement is not possible, the joint products must be converted to some common denominator. For example, while manufacturing coke, the joint products like coke, benzol, coal tar, gas and sulfate of ammonia are measured in different units and the yield of recovered units of these products is measured on the basis of product quantity extracted per ton of coal used.

Example

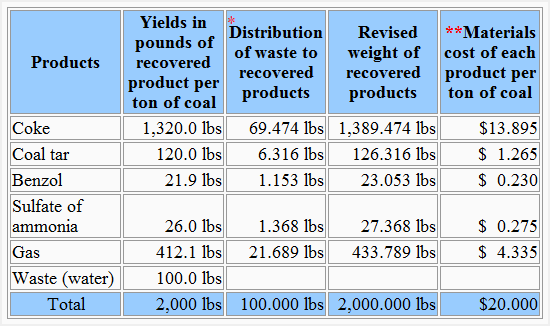

In the table given below, the weight is used as the measurement unit to illustrate the use of quantitative unit method of allocating joint production cost.

*Distribution of waste to recovered products:

(Yield in pounds of recovered products per ton of pound × Waste)/Total weight in pounds excluding the weight of waste

- Coke: (1,320 × 100)/(2,000 – 100) = 69.474 lbs

- Coal tar: (120 × 100)/(2,000 – 100) = 6.316 lbs

- Benzol: (21.9 × 100)/(2,000 – 100) = 1.153 lbs

- Sulfate of ammonia: (26 × 100)/(2,000 – 100) = 1.368 lbs

- Gas: (412.1 × 100)/(2,000 – 100) = 21.689 lbs

**Materials cost of each product per ton of coal:

(Revised weight of recovered products × Joint cost)/Total weight after distributing the weight of waste

- Coke: (1,389.474 × 20)/2,000 = $13.895

- Coal tar: (126.316 × 20)/2,000 = $1.265

- Benzol: (23.053 × 20)/2,000 = $0.230

- Sulfate of ammonia: (27.368 × 20)/2,000 = $0.275

- Gas: (433.789 × 20)/2,000 = $4.335

Leave a comment