Weighted average method of joint cost allocation

Explanation

Under weighted average method of joint cost allocation, certain predetermined weight factors are assigned to each unit of joint products. The finished units are multiplied by the weight factors to obtain the number of weighted units which are then used to prorate the total joint production cost among individual units of joint products.

For example 10,000 units of product X and 20,000 units of product Y are produced in a joint production process. If a weight factor of 5 is assigned to product X and a weight factor of 3 is assigned to product Y, the weighted number of units of product can be computed using the following formula:

Weighted units = Units produced × weight factor

The number of weighted units of product X and product Y can be computed as follows:

- Weighted units of product X: 10,000 units × 5 points = 50,000 units

- Weighted units of product Y: 20,000 units × 3 points = 60,000 units

The weight factors are determined for each joint product on the basis of core product characteristics and manufacturing requirements such as amount of direct materials used, size of the unit of product, difficulty or complexity involved in manufacturing a unit of product, amount of time required to manufacture a unit of product and the type of labor engaged to complete the production etc.

Like traditional average unit cost method, the application of weighted average method is simple and straight forward. However, it is used in industries where other available methods such as market value method, quantitative unit method and average unit cost method cannot be satisfactorily used for the allocation of joint production costs.

The following example would be helpful to understand the basic procedure of allocating joint production cost to joint products under weighted average unit cost method.

Example

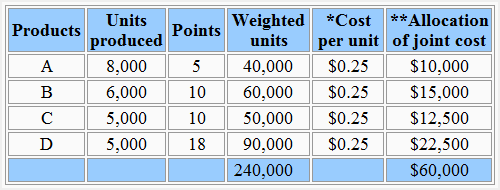

The Rama Company processes a single raw material through a single manufacturing process to produces four products – product A, product B, product C and product D. The quantities of these four products produced in a recently completed production run are given below:

- Product A: 8,000 units

- Product B: 6,000 units

- Product C: 5,000 units

- Product D: 5,000 units

The joint production cost incurred in the production run is $60,000.

The company uses a weighted average method for allocating joint production costs to various products. The weight factors assigned to four products are as follows:

- Product A: 5 points

- Product B: 10 points

- Product C: 10 points

- Product D: 18 points

Required: Allocate the joint cost of $60,000 among four joint products using weighted average method.

Solution

*Joint production cost/Total number of weighted units

= $60,000/240,000 units

= $0.25

**Weighted units of product × Cost per unit

Product A: 40,000 × $0.25 = $10,000

Product B: 60,000 × $0.25 = $15,000

Product C: 50,000 × $0.25 = $12,500

Product D: 90,000 × $0.25 = $22,500

Leave a comment