Variable and absorption costing with just in time (JIT) manufacturing system

Companies using both variable and absorption costing often find a difference in the net operating income figures produced by the income statements prepared under these two costing methods. This difference may be huge as well as confusing, especially for those who do not fully understand how these two costing approaches work.

As discussed in the previous lesson, there are two basic reasons for the different net operating income between variable and absorption costing – the different treatment of fixed manufacturing overhead under two costing approaches and the change in the units in inventory during the period. Under absorption costing, the fixed portion of manufacturing overhead is included in the product cost, whereas under variable costing, it is treated as the period cost and expensed immediately in its entirety each period. A change in inventory happens whenever the number of units sold is different from the number of units produced during the period.

In the previous lesson, we have discussed and exemplified how these two factors cause the different net operating incomes under two costing approaches. Therefore, before reading further, we highly recommend that you read the previous lesson first and then come back to this lesson to continue. Click here to read the previous lesson.

The impact of just-in-time (JIT) or lean production method

The difference in the net operating income under variable and absorption costing can largely be reduced, or even eliminated, by using a manufacturing method called just-in-time (JIT) or lean production. Under this method, the units of a product are manufactured to customers’ orders only. This method, therefore, encourages companies to eliminate finished goods inventory entirely and reduce work-in-process inventory to the minimum possible level. When inventories are eliminated, the change in inventory does not happen, and hence, the difference in net operating income under variable and absorption costing disappears.

The adoption of a just-in-time (JIT) or lean production method does not impact the computation of unit product cost. Therefore, the value of inventories and the cost of goods sold will still be different between variable and absorption costing. The method just attempts to eliminate inventories, which are the root cause of the difference in net operating income between the two costing approaches. When inventories don’t exist, the question of the change in inventories does not arise, and the income statements under variable and absorption costing produce the same net operating income.

Example:

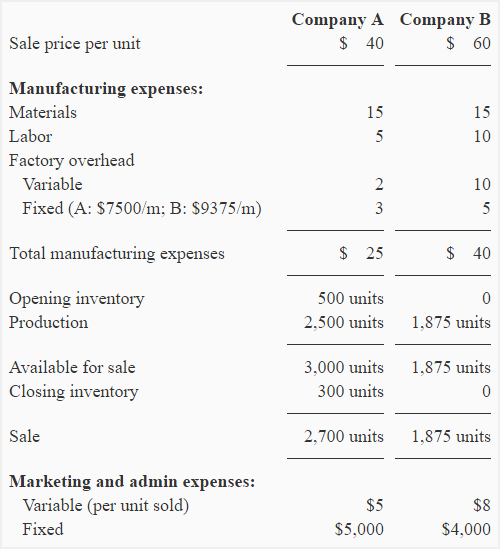

The following data relates to two manufacturing companies – company A and company B. Company A uses a traditional manufacturing system, whereas Company B uses a strict just-in-time (JIT) manufacturing system and does not manufacture a unit unless an order is received for it.

Now we will prepare the income statements of both companies under variable costing and absorption costing approaches and observe the impact of the just-in-time (JIT) manufacturing system on Company B’s net operating income.

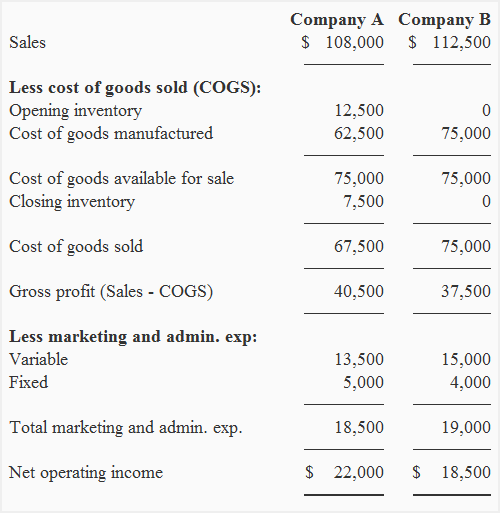

Absorption costing income statement:

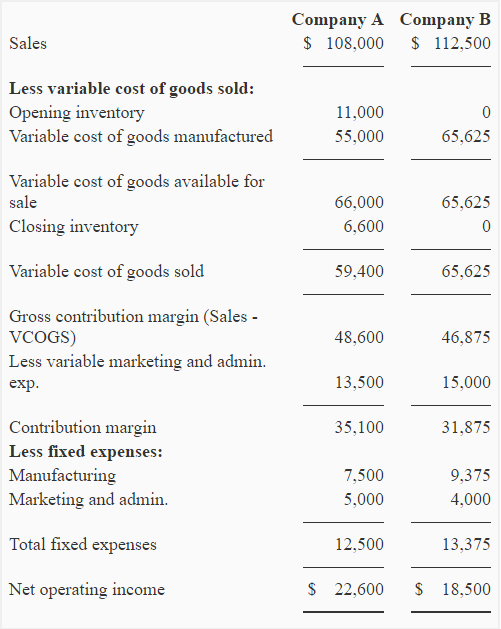

Variable costing income statement:

Why Company A’s net operating income is different under variable and absorption costing

Company A has both beginning and ending inventory figures on its income statement, which means it operates under a traditional manufacturing system. Since Company A has not adopted a just-in-time (JIT) or lean production methodology, its net operating income is different between variable and absorption costing approaches. This difference has essentially emerged due to a change in inventory during the period from 500 units to 300 units.

As mentioned earlier, the fixed manufacturing overhead is a part of the product cost under absorption costing. Therefore, when absorption costing is used, the cost of each unit of inventory includes a portion of fixed manufacturing overhead. If inventory increases during the period and absorption costing is being used, the fixed manufacturing overhead is deferred in the inventory to the next period, decreasing the cost burden of the current period. In such situations, the net operating income under absorption costing will always be higher than variable costing. If, on the other hand, inventory decreases during the period and absorption costing is being used, the fixed manufacturing overhead is released from inventory, increasing the cost burden of the current period. In such situations, the net operating income under absorption costing will always be lower than variable costing.

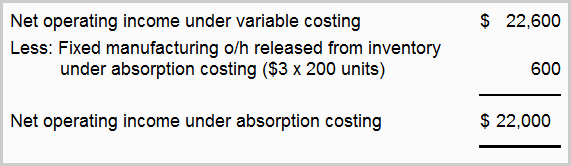

Since Company A’s sales have exceeded its production by 200 units, its inventory has gone down by the same number of units during the period. As a result, the fixed manufacturing overhead that was deferred in inventory in the previous period has flowed through to the income statement of the current period. It means that the cost of goods sold (COGS) figure for the current period includes not only the fixed manufacturing overhead cost of the current period but also a portion of this cost from the previous period. So, this increase in cost burden has caused a lower net operating income in the current period under absorption costing than it is under variable costing. The amount of fixed manufacturing overhead that has been released from inventory during the current period under absorption costing is $600, as computed below:

Decrease in inventory during the period x Per unit fixed manufacturing overhead

200 units x $3.00 per unit

= $600

Under variable costing, the fixed manufacturing overhead is not a part of the product cost; rather, it is treated as a period or capacity cost and is fully expensed as incurred during each period. In other words, each period must bear its entire fixed manufacturing overhead cost under variable costing, irrespective of any increase or decrease in inventory during the period. Hence, no deferral or release of fixed manufacturing overhead takes place under the variable costing approach.

Reconciliation of Company A’s variable costing and absorption costing net operating incomes

Since Company A’s inventory has decreased during the period, the fixed manufacturing overhead cost has been released from inventory under absorption costing. So, in order to reconcile variable costing and absorption costing net operating incomes, we need to deduct the amount of released fixed manufacturing overhead from the variable costing net operating income to arrive at the absorption costing net operating income.

Why Company B’s net operating income is the same under variable and absorption costing

Company B has no beginning and ending inventory units, which means it strictly follows just-in-time (JIT) or lean production principles. Since this company does not maintain any inventory, the change in inventory and the deferral or release of fixed manufacturing overhead have not taken place during the period under absorption costing. The net operating income of Company B is, therefore, the same under both variable and absorption costing approaches.

Important points to remember

- A company that uses both variable and absorption costing often finds a difference in its net operating income determined under these two costing approaches.

- The difference in net operating income between variable and absorption costing is jointly caused by two factors – the different treatment of fixed manufacturing overhead under two costing approaches and the change in the number of units in inventory during the period concerned.

- This difference can be minimized, or even eliminated, by adopting a strict just-in-time (JIT) or lean manufacturing methodology, under which production is geared to customers’ orders only and inventories are eliminated or minimized as much as possible.

Leave a comment