Treasury stock – par value method

The transactions relating to purchase and sale of treasury stock are generally accounted for using one of the two methods. These are cost method and par value method. The following discussion explains the accounting treatment of treasury stock using par value method, if you want to read about cost method, please read “treasury stock – cost method” article.

Purchase of treasury stock – par value method

When a company purchases its own shares and uses par value method for accounting purpose, the treasury stock account is debited with the total par value of shares acquired and cash account is credited with the amount of cash paid. If the debit part of the journal entry exceeds the credit part, the difference is credited to the additional paid-in capital from treasury stock and if, on the other hand, credit part of the journal entry exceeds the debit part, the difference is debited to the additional paid-in capital from treasury stock and if additional paid in capital from treasury stock is not available or is not sufficient, retained earnings account is debited with the rest of the amount.

Reissuance of treasury stock – par value method:

Under par value method, when shares of treasury stock are reissued, the cash account is debited with the amount of cash received and treasury stock is credited with the par value of shares reissued. If the amount of cash received is more than the total par value of shares reissued, the difference is credited to the additional paid-in capital from treasury stock and if, on the other hand, the amount of cash received is less than the total par value of shares reissued, the difference is debited to the additional paid-in capital from treasury stock and if additional paid in capital from treasury stock is not available or is not sufficient, the retained earnings account is debited with the rest of the amount.

Consider the following example for a better explanation:

Example

The following transactions relate to Metro corporation:

- Issued 2,000 shares of $5 par vale common stock at $20 per share.

- Bought back 300 shares at $18 per share.

- Bought back 400 shares at $25 per share.

- Reissued 200 shares at $30 per share.

Required: Prepare journal entries using above transactions. Assume Metro corporation uses par value method of treasury stock.

Solution:

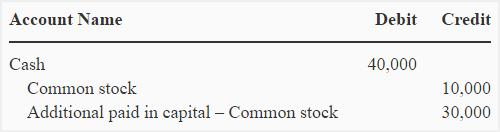

(1). At the time of issuing 2,000 shares:

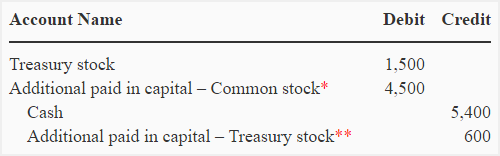

(2). At the time of buying back 300 shares:

*Additional paid in capital – common stock of 300 shares: 300 × (20 – 5)

**Additional paid in capital – treasury stock has been credited with the balancing amount: (1500 + 4,500 – 5,400)

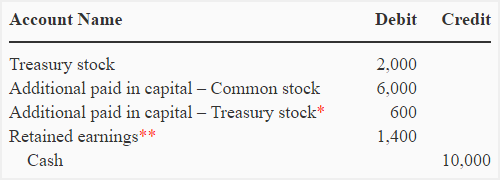

(3). At the time of buying back 400 shares:

*Available additional paid-in capital from treasury stock (see journal entry No. 2)

**Retained earnings account has been debited with the balancing amount (10,000 – 2,000 – 6,000 – 600)

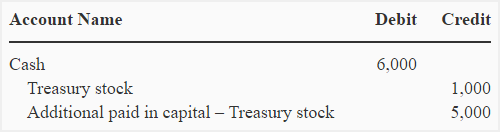

(4). At the time of reissuing 200 shares:

Leave a comment