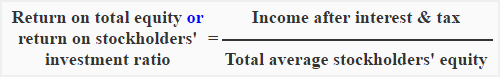

Return on total equity or shareholders’ investment ratio

Return on shareholders’ investment ratio is a measure of overall profitability of the business and is computed by dividing the net income after interest and tax by average stockholders’ equity. It is also known as return on total equity (ROTE) ratio and return on net worth ratio. The ratio is usually expressed in percentage.

Formula:

The numerator consists of net income after interest and tax because it is the amount of income available for common and preference stockholders. The denominator is the average of stockholders’ equity (preference and common stock). The information about net income after interest and tax is normally available from income statement and the information about preference and common stock is available from balance sheet.

Note for students: Analysts usually prefer to use the average stockholders’ equity as denominator. The students can, however, use the closing figure of stockholders’ equity if the opening figure is not given in the question.

Example:

The following data has been extracted from the income statement and balance sheet of PQR limited:

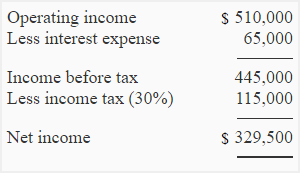

Data extracted from income statement for the year ended December 31, 2016:

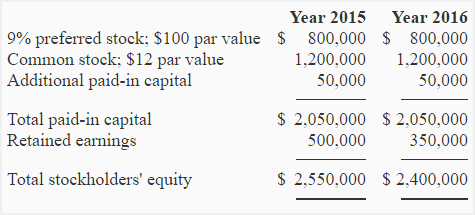

Data extracted from balance sheets as at December 31, 2015 and 2016:

Required: Compute return on shareholders’ investment/return on total equity ratio

Solution:

= (329,500 / 2,475,000*) × 100

= 13.31%

*Average stockholders’ equity:

= (2,400,000 + 2,550,000) / 2

= 2,475,000

The return on shareholders’ investment or return on equity (ROE) ratio of PQR limited is 13.31%. It means for every $100 invested by shareholders’, the company earns $13.31 after interest and tax.

Significance and Interpretation:

Return on total equity (ROE) is used to measure the overall profitability of the company from preference and common stockholders’ point of view. The ratio also indicates the efficiency of the management in using the resources of the business.

Higher ratio means higher return on shareholders’ investment and a lower ratio indicates otherwise. Investors always search for the highest return on their investment and a company that has higher ROE ratio than others in the industry attracts more investors.

Leave a comment