Quick ratio or acid test ratio

Quick ratio (also known as “acid test ratio” and “liquid ratio“) is used to test the ability of a business to pay its short-term debts. It measures the relationship between liquid assets and current liabilities. Liquid assets are equal to total current assets minus inventories and prepaid expenses.

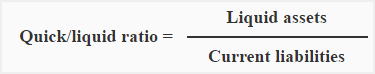

Formula

The formula for the calculation of quick ratio is given below:

Example

The following are the current assets and current liabilities of PQR Limited:

Current assets:

- Cash: $2,400

- Accounts receivable: $12,000

- Inventory: $16,000

- Prepaid expenses: $600

Current liabilities:

- Accounts payable: $11,600

- Accrued parables: $1,800

- Notes payable: $600

Calculate quick ratio of PQR Limited.

Solution

= 14,400*/14,000**

= 1.03

(rounded to two decimal places)

*Liquid assets:

= (Total current assets) – (Inventories + Prepaid expenses)

=$31,000 – ($16,000 + $600)

= $31,000 – $16,600

= $14,400

** Current liabilities:

= $11,600 + $1,800 + $600

= $14,000

Significance and Interpretation

Quick ratio is considered a more reliable test of short-term solvency than current ratio because it shows the ability of the business to pay short term debts immediately.

Inventories and prepaid expenses are excluded from current assets for the purpose of computing quick ratio because inventories may take long period of time to be converted into cash and prepaid expenses cannot be used to pay current liabilities.

Generally, a quick ratio of 1:1 is considered satisfactory. Like current ratio, this ratio should also be interpreted carefully. Having a quick ratio of 1:1 or higher does not mean that the company has a strong liquidity position because a company may have high quick ratio but slow paying debtors. On the other hand, a company with low quick ratio may have fast moving inventories. The analyst, therefore, must have a hard look on the nature of individual assets.

Leave a comment