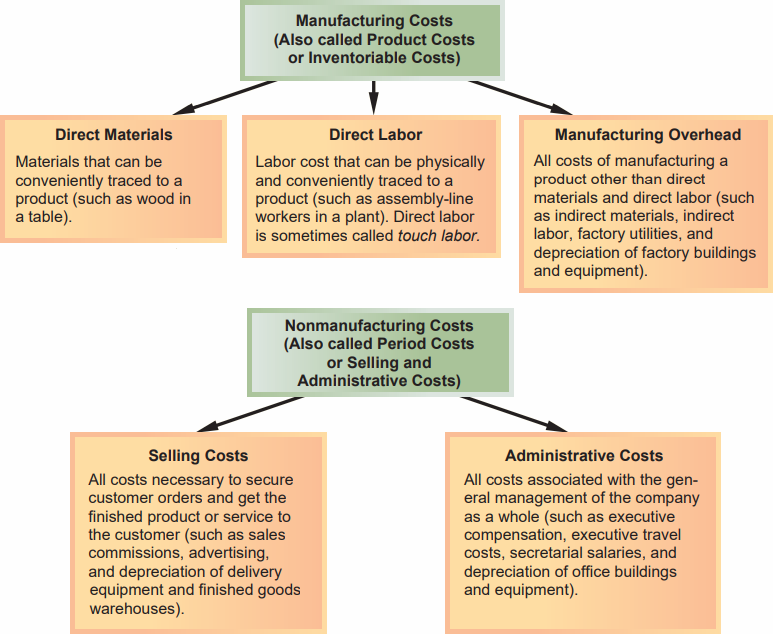

Product costs and period costs

In addition to categorizing costs as manufacturing and nonmanufacturing, they can also be categorized as either product costs or period costs. This classification relates to the matching principle of financial accounting. Therefore, before talking about how a product cost differs from a period cost, we need to look at what the matching principle says about the recognition of costs.

A cost is reflected in the income statement as expense in the period during which the benefit pertaining to that cost is obtained and recognized in the books. Suppose, for example, a company makes a payment of $2,000 for liability insurance in advance for two years – year A and year B. The whole amount would not be expensed at once in year A, but instead only $1,000 (= $2,000 x 1/2) would be considered the valid expense of each of the two years. The reason is that both the years would benefit from this insurance payment, and not just the year A. The unexpensed amount at the end of year A (i.e., $1,000) would be reflected in the balance sheet as prepaid insurance, a current asset.

The matching principle, which is based on accrual concept of financial accounting, states that the cost incurred for generating a certain revenue should be recorded in books as expense in the same period that the revenue is recorded. It means that if a business incurs a cost to produce or acquire a saleable product, the cost should be recognized as expense only when the product is actually sold and the benefit flows into the business in the form of revenue.

Now that we have taken a bird’s eye view of the matching principal, let’s look into the meanings of and difference between product costs and period costs.

Product costs:

Product costs (also known as inventoriable costs) are those costs that are incurred to acquire, manufacture or construct a product. In manufacturing companies, theses costs usually consist of direct materials, direct labor, and manufacturing overhead cost.

Product costs are initially attached to product inventory and do not appear on income statement as expense until the product for which they have been incurred is sold and generates revenue for the business. When the product is sold, these costs are transferred from inventory account to cost of goods sold account and appear as such on the income statement of the relevant period. For example, John & Muller company manufactures 500 units of product X in year 2022. Out of these 500 units manufactured, the company sells only 300 units during the year 2022 and 200 unsold units remain in ending inventory. The direct materials, direct labor and manufacturing overhead costs incurred to manufacture these 500 units would be initially recorded as inventory (i.e., an asset). The cost of 300 units would be transferred to cost of goods sold during the year 2022 which would appear on the income statement of 2022. The remaining inventory of 200 units would not be transferred to cost of good sold in 2022 but would be listed as current asset in the company’s year-end balance sheet. These unsold units would continue to be treated as asset until they are sold in a following year and their cost transferred from inventory account to cost of goods sold account.

From above example, it is apparent that the product costs like direct materials, direct labor and manufacturing overhead might be incurred during one period but expensed in a following period when the related goods are sold. The product costs are sometime named as inventoriable costs because they are initially assigned to inventory and expensed only when the inventory is sold and revenue flows into the business.

Period costs:

The costs that are not classified as product costs are known as period costs. These costs are not part of the manufacturing process and are, therefore, treated as expense for the period in which they arise. Period costs are not attached to products and the company does not need to wait for the sale of its products to recognize them as expense on income statement. According to generally accepted accounting principles (GAAPs), all selling and administrative costs are treated as period costs.

The costs incurred to secure customer orders and deliver the sold items to customers are examples of selling expenses. They generally include:

- all types of sales commission,

- advertising expenses,

- public relations,

- cost of storing finished goods in warehouse and storeroom,

- product packaging costs and

- depreciation recorded on bikes, vans and trucks used for delivering orders to customers.

The costs incurred for general management and administration of the company are examples of administrative costs. They generally include:

- compensation paid to company executives,

- travelling costs incurred for business tours,

- secretarial remunerations,

- depreciation recorded on office furniture and buildings and

- depreciation recorded on computers, printers, scanners and other equipment installed in administrative offices.

A summary of the concept of product cost and period cost

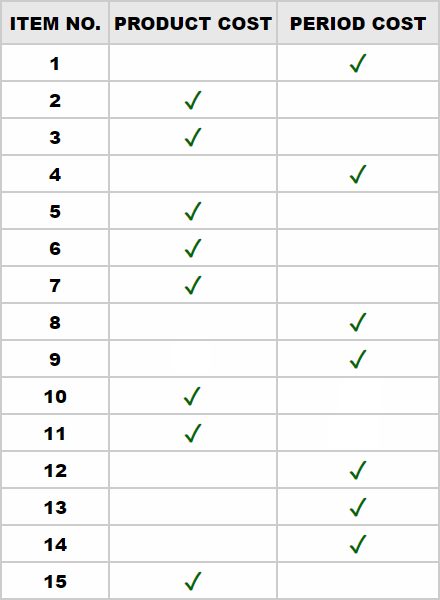

Example

Suppose you have a job as an intern in Camster, a privately owned camera manufacturing company. The company asks you to help prepare its financial statements. For this purpose, Camster has provided you a list of fifteen costs which are listed below:

- Depreciation on cars used by salespersons.

- Rent paid for the equipment installed in the factory.

- Grease and oil used for lubricating machines.

- Salaries of employees working in finished goods warehouse area.

- Cleanser, soap and towels used by factory labor at the end of work shifts.

- Salaries of factory supervisors.

- Gas, electricity and water consumed in the factory.

- Boxes used for shipping units abroad (not used for ordinary product packaging).

- Marketing and advertising costs.

- Employee’s compensation insurance for factory workers.

- Depreciation on furniture present in the factory lunchroom.

- Receptionists’ salaries in administrative offices.

- Cost of leasing the corporate jet for company’s executives.

- Rent of the hotel’s hall used for annual sales conference.

- Cost of routine product packaging.

Required: Classify each of the above costs as either product cost or period cost for the purpose of financial statement preparation.

Solution

The cost classification as product cost or period cost has been made below:

Leave a comment