Inventory turnover ratio (ITR)

Definition and explanation

Inventory turnover ratio (ITR) is an activity ratio which evaluates the liquidity of a company’s inventory. It measures how many times a company has sold and replaced its inventory during a certain period of time. For example, having an inventory turnover ratio of 10 means the firm has sold and refilled its average inventory 10 times during the period selected for analysis.

A higher ITR number may signify a better inventory procurement and effective use of resources allocated to promote sales. A lower number, on the other hand, may indicate otherwise. Other names used for this ratio include stock turnover ratio, inventory turns, stock turns and rate of stock turnover.

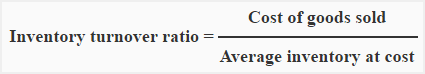

Formula

Inventory turnover ratio is computed by dividing the cost of goods sold by average inventory at cost. The formula/equation is given below:

Two components of the formula of ITR are cost of goods sold and average inventory at cost. Cost of goods sold is equal to cost of goods manufactured (purchases for trading company) plus opening inventory less closing inventory. Average inventory in denominator part of the formula is equal to opening balance of inventory plus closing balance of inventory divided by two. The use of average inventory rather than just the year-end inventory balance helps minimize the impact of seasonal variations in turnover.

A note for students:

If cost of goods sold is unknown, the net sales figure can be used as numerator and if the opening balance of inventory is unknown, closing balance can be used as denominator. For example, if only sales and year-end inventory balance is given in the problem or homework assignment, then there would be no other option but to apply the following formula:

Inventory turnover ratio = Sales/Inventory

Examples of inventory turnover ratio

Let’s exemplify the computation of ITR.

Example 1:

True Dreamers is a US based small trading company. It reports a net sales revenue of $75,000 and a gross profit of $35,000 on its income statement for the year 2022. The opening and closing inventory balances are $9,000 and $7,000 respectively. Calculate average inventory, inventory turnover ratio and average selling period for 2022.

Solution:

(i). Average inventory:

(Opening inventory + Closing inventory)/2

= ($9,000 + $7,000)/2

= $16,000/2

= $8,000

(ii). Inventory turnover ratio:

Cost of goods sold/Average inventory at cost

= $40,000*/$8,000

= 5 times

*Cost of goods sold:

Sales – Gross profit

= $75,000 – $35,000

= $40,000

The ITR of True Dreamers is 5 or 5 times which means it has sold its average inventory 5 times during 2022.

(iii). Average selling period:

The average selling period is the number of days True Dreamers takes to sell its average inventory. It can be computed by dividing the number of days in a year by the inventory turnover ratio (ITR):

Number of days in a year/ITR

= 365 days/5 times

= 73 days

The company takes 73 days to sell its average inventory.

Example 2

Blessed Forever, a trading corporation, has an ITR ratio of 12 times for the first quarter of the year 2022. If its opening and closing inventory balances are $36,000 and $54,000 respectively, what would be the corporation’s cost of goods sold for the quarter?

Solution

Inventory turnover ratio = Cost of goods sold/Average inventory at cost

12 times = Cost of goods sold/$45,000*

Cost of goods sold = $45,000 × 12 times

= $540,000

*($36,000 + $54,000)/2

Example 3

The income statement of Duro Items Inc. shows a net sales of $660,000 and balance sheet shows an inventory amounting to $44,000. Workout the inventory turnover ratio of Duro Items.

Solution

In this question, the only available information is the net sales and closing balance of inventory. We can’t workout cost of goods sold and average inventory from this information. Here, the only math we can do to compute ITR is to divide the net sales by the inventory.

Inventory turnover ratio = Net sales/Inventory

= $660,000/$44,000

= 15 times

Significance and interpretation

Inventory turnover ratio vary significantly among industries. If a financial statement user wants to calculate and compare the ratio of two firms, he must make sure that both the firms are perfect competitors of each other i.e., both fall within the same industry and their business models are essentially the same.

A high ratio indicates that the firm is dealing in fast moving inventories and a low ratio, on the other hand, indicates slow moving or obsolete inventories lying in stock. A low ratio may also be the result of overstocking. Maintaining inventory in larger quantity than needed indicates poor efficiency on the part of inventory management because it involves blocking funds that could have been used in other business operations. Moreover, excessive quantities in stock always pose a risk of loss due to factors like damage, theft, spoilage, shrinkage and stock obsolescence.

Before interpreting the inventory turnover ratio and making an opinion about a firm’s operational efficiency, it is important to investigate how the firm assigns cost to its inventory. For example, companies using FIFO cost flow assumption may have a lower ITR number in days of inflation because the latest inventory purchased at higher prices remain in stock under FIFO method. Conversely, the companies using LIFO cost flow assumption may have comparatively a higher ratio than others because the oldest inventory purchased at lower prices remain in stock under LIFO method. The exact reverse might be true in deflationary situations.

Another factor that could possibly affect the inventory turnover ratio is the use of just-in-time (JIT) inventory management method. Companies employing JIT system may have a higher ITR than others that don’t practice JIT. The reason is that such companies generally have much lower inventory balances to report on their balance sheet as compared to those that just rely on traditional approaches of inventory restocking. Similarly, a shortage of inventory in stock may also temporarily rise the firm’s inventory turnover ratio.

Leave a comment