Debt to equity ratio

Debt to equity ratio (also termed as debt equity ratio) is a long term solvency ratio that indicates the soundness of long-term financial policies of a company. It shows the relation between the portion of assets financed by creditors and the portion of assets financed by stockholders.

Since debt to equity ratio expresses the relationship between external equity (liabilities) and internal equity (stockholders’ equity), it is also known as “external-internal equity ratio”.

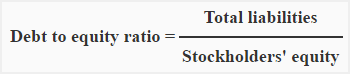

Formula:

Debt to equity ratio is calculated by dividing total liabilities by stockholder’s equity.

The numerator in above formula consists of total current and long-term liabilities and the denominator consists of total stockholders’ equity, including preferred stock, if any. Both the elements of the formula can be obtained from company’s balance sheet.

Examples of debt to equity ratio

Example 1:

Robertson Company has applied for a loan. The lender of the loan requests you to compute the debt to equity ratio as a part of long-term solvency test of the company.

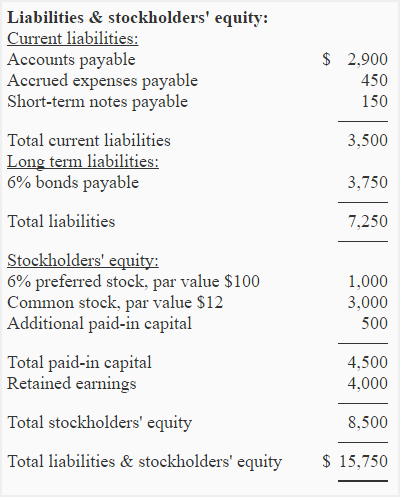

The “Liabilities and Stockholders’ Equity” section of the balance sheet of Robertson is given below:

Required: Compute debt to equity ratio of Robertson Company.

Solution:

Debt to equity ratio = Total liabilities/Stockholders’ equity

= 7,250/8,500

= 0.85

The debt to equity ratio of Robertson Company is 0.85 or 0.85 : 1, which means the liabilities are 85% of stockholders equity. In other words, we can say that the creditors provide 85 cents for each dollar provided by stockholders to finance the Robertson’s assets.

If debt to equity ratio and one of the other two equation elements is known, we can work out the third element. Consider the example 2 and 3 below:

Example 2

Petersen Trading Company has total liabilities of $937,500 and a debt to equity ratio of 1.25. Calculate total stockholders’ equity of Petersen Trading Company.

Solution

Debt to equity ratio = Total liabilities/Total stockholder’s equity

or

Total stockholder’s equity = Total liabilities/Debt to equity ratio

= $937,500/1.25

= $750,000

Example 3

Steward Corporation’s debt to equity ratio for the last year was 0.75 and stockholders’ equity was $750,000. What was the total liabilities of the corporation?

Solution

Debt to equity ratio = Total liabilities/Total stockholder’s equity

or

Total liabilities = Stockholders’ equity × Debt to equity ratio

= $750,000 × 0.75

= $562,500

Significance and interpretation:

Debt to equity ratio is one of the widely used gearing ratios that tells investors and analysts the extent to which a company relies on borrowed funds compared to equity financing. A ratio of 1 (or 1:1) means that the creditors and stockholders equally contribute to the assets of the business. A less than 1 ratio indicates that the portion of assets financed by stockholders is greater than the portion of assets financed by creditors. A greater than 1 ratio, on the other hand, indicates otherwise. A significantly higher ratio reveals that the firm is heavily relying on debt financing for its operations, which may place its business at risk.

Creditors generally like a low debt to equity ratio, because it ensures that the firm is not already heavily relying on debt which ultimately indicates a greater protection to their funds. A significantly low ratio may, however, also be found in companies that reluctant to take the advantage of debt financing for growth.

Debt to equity ratio varies from industry to industry and therefore different norms have been developed for different industries. A ratio that is considered ideal in one industry may be worrisome in another. For most of the industrial undertakings, a ratio of 1 : 1 is considered satisfactory.

For comparison of two or more companies, analyst should obtain the ratio of only those companies whose business models are the same and that directly compete with each other within the industry.

Leave a comment