Accrual concept of accounting

Accrual accounting is a system used by companies to record their financial transactions at the point when they occur, regardless of when a cash transfer is made. It is unlike cash accounting, under which a transaction is deemed valid for recording when cash is actually received or paid.

The accrual concept of accounting requires that accounting records, including journal, ledger, and income statement, reflect transactions at the time when they actually occur, not necessarily when cash changes hands. This basis of accounting is generally used by companies for preparing their financial statements, except the cash flow statement.

Under accrual accounting, revenue is recorded when it is earned, regardless of when it is received in cash, and expenses are recorded when a benefit from them is gained, regardless of when they are paid in cash. Also read the revenue recognition principle and the expense recognition principle.

Let’s take an example for a better understanding of the concept.

Example of accrual concept:

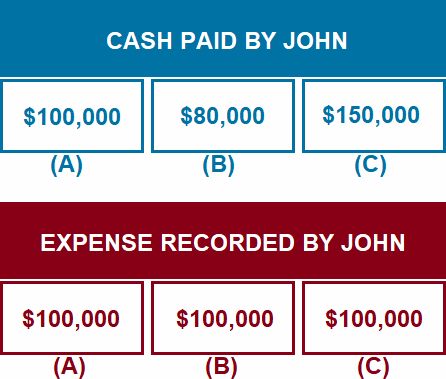

Suppose Mr. John obtains a building from Mr. Sam for business purposes at a rent of $100,000 per year. Now consider the following three cases in which John pays cash to Sam and records the rent expense in his business books:

In the above example, even though the amount of cash paid is different in all three cases, the rent expense recorded is $100,000 in each case. The justification behind this treatment is the accrual concept of accounting, in which expenses must be recorded in the period in which they are incurred, not in the period in which they are paid.

Notice that in case “B”, John has paid $80,000 cash but has recorded a $100,000 expense during the period because the annual rent of the building is $100,000, not $80,000. The remaining $20,000 is a current liability, known as rent payable, which will be settled in a subsequent period. Also notice that in case “C” John has paid $150,000 cash but has again recorded only $100,000 as rent expense. The balance of $50,000 is a current asset known as prepaid rent, which can be adjusted against the rent of a subsequent period.

The accrual concept of accounting may be a little complex for some people, but it has many benefits. It is also one of the basic assumptions for keeping records under major accounting frameworks like US-GAAP and IFRS.

Benefits and importance of the accrual approach:

Some important and salient benefits of following the accrual concept of accounting are listed below:

- Under the accrual concept of accounting, financial statements reflect all the expenses associated with the reported revenues for a particular accounting period. The concept, therefore, increases the accuracy, usefulness, and reliability of financial information for common stakeholders.

- The concept satisfies the requirements of major accounting frameworks applicable worldwide, such as generally accepted accounting principles (GAAPs) and international financial reporting standards (IFRSs).

- This is one of the common assumptions that are considered while interpreting the financial statements of commercial entities.

- The departure from the accrual concept limits users’ ability to compare the financial statements of an entity with those of others and thus reduces the usefulness of financial statements from an investor’s perspective.

Can I get a PDF sheets for all above explanations.

I like it