Dual aspect concept of accounting

Definition and explanation

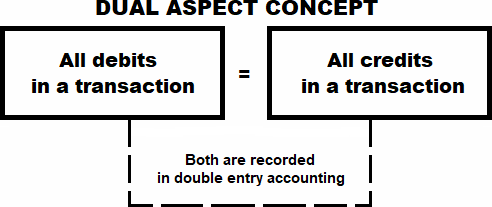

The dual aspect concept is a foundational principle of the double entry system of accounting. It states that every accounting transaction has a dual effect – that is, an equal and corresponding effect that impacts two different accounts. In essence, it means that every valid transaction in a business has both a debit and a credit effect. This concept ensures the accurate reporting of financial transactions and, finally, the accurate presentation of financial statements.

Since the dual aspect concept itself is based on the fundamental accounting equation, it is not possible to employ true double entry accounting without adherence to this concept. In fact, the equation is a formal expression of the dual aspect concept. The accounting equation, in its basic form, can be expressed as follows:

Assets = Liabilities + Owner’s equity

Example to demonstrate the concept

As mentioned earlier, the dual aspect concept involves the booking of two effects for each business transaction – a debit effect and a credit effect. Debits generally include an increase in expenses, assets, and receivables. They can also include a reduction in liabilities. Credits involve an increase in income, capital, and liabilities that impact the balance sheet. They can also denote a reduction in assets and receivables.

Let’s understand the concept with the help of an example.

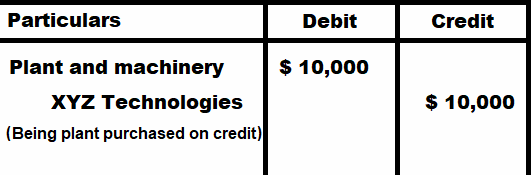

ABC, Inc. is a manufacturing entity. At the start of the current year, it purchased a new processing plant for $10,000 from XYZ Technologies Inc. on credit.

This transaction has a dual impact on the company’s financial position. It impacts assets as there is an inflow of a new asset – the plant. At the same time, it impacts liabilities because the plant was purchased on credit. According to the dual aspect concept, the accounting entry for this transaction would be recorded as follows:

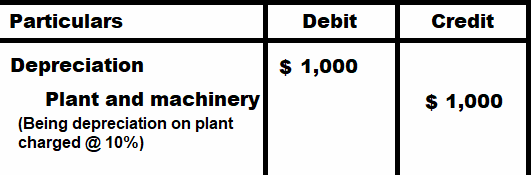

Let’s extend this example further. Suppose, after the completion of the first year of use, the company must record a 10% depreciation on the plant. This, too, has a dual impact. Firstly, an expense or charge against profit would be created for the amount of yearly depreciation, which is a debit entry. Secondly, the asset value would be reduced, which is a credit entry. (You might want to read the rules of debit and credit article).

The proper accounting journal entry for this charge would be:

Benefits and usefulness of dual aspect concept

The adoption of the dual aspect concept of accounting has several benefits. These include:

1. Accurate presentation of financial statements

By recording both debit and credit aspects of a transaction, the concept ensures a correct representation of the financial flow of each transaction the business conducts during a period. Thus, the financial records can be accurately maintained, and the financial statements reflect a true picture of the organization’s financial performance and health.

2. Aids error tracing

If the trial balance and balance sheet of an organization do not tally, it will be relativey easy to trace and uncover mistakes or errors by tracing both effects of transactions when they are recorded under the dual aspect concept.

3. Has global recognition

The dual aspect of double-entry accounting is a globally recognized and accepted accounting concept. The adoption of this concept enables organizations to prepare their books of accounts as well as get their financial statements audited. Moreover, only the accounts and statements that adhere to this concept would be acceptable to external stakeholders such as bankers, creditors, the government, and valuators, etc.

4. Aids comparability

The dual aspect concept ensures consistency in account preparation and thus aids in the comparability of account statements across periods. It also allows the comparison of the financial statements of one entity with those of others.

Leave a comment