Accounting equation

Accounting equation describes that the total value of assets of a business entity is always equal to its liabilities plus owner’s equity. This equation is the foundation of modern double entry system of accounting being used by small proprietors to large multinational corporations. Other names used for this equation are balance sheet equation and fundamental or basic accounting equation.

Definition and explanation

We know that every business holds some properties known as assets. The claims to the assets owned by a business entity are primarily divided into two types – the claims of creditors and the claims of owner of the business. In accounting, the claims of creditors are referred to as liabilities and the claims of owner are referred to as owner’s equity.

Accounting equation is simply an expression of the relationship among assets, liabilities and owner’s equity in a business. The general form of this equation is presented below:

Assets = Liabilities + Owner’s Equity

Notice that the left hand side (also known as assets side) of the equation shows the resources owned by the business and the right hand side (also known as equity side) shows the sources of funds used to acquire these resources. All assets owned by a business are acquired with the funds supplied either by creditors or by owner(s). In other words, we can say that the value of assets in a business is always equal to the sum of the value of liabilities and owner’s equity. The total dollar amounts of two sides of accounting equation are always equal because they represent two different views of the same thing.

In accounting equation, the liabilities are normally placed before owner’s equity because the rights of creditors are always given a priority over the rights of owners. Because of this preference, the liabilities are sometime transposed to the left side which results in the following form of accounting equation:

Assets – Liabilities = Owner’s Equity

If dollar amounts of any two of the three elements are known, we can solve the equation to find the third one. For example, if a business owns total assets amounting to $400,000 and total liabilities amounting to $120,000, the owners equity must be equal to $280,000 as computed below:

Assets – Liabilities = Owner’s Equity

$400,000 – $120,000 = $280,000

Example 1:

Using the concept of accounting equation, compute missing figures from the following:

- Assets = $100,000, Liabilities = $40,000, Owner’s equity = ?

- Assets = ?, Liabilities = $20,000, Owner’s equity = $30,000

- Assets = $120,000, Liabilities = ?, Owner’s equity = $80,000

- Assets = ?, Liabilities + Owner’s equity = $300,000

Solution

- Owner’s equity = Assets – Liabilities

= $100,000 – $40,000

= $60,000 - Assets = Liabilities + Owner’s equity

= $20,000 + $30,000

= $50,000 - Liabilities = Assets – Owner’s equity

= $120,000 – $80,000

= $40,000 - The basic accounting equation is: Assets = Liabilities + Owner’s equity. Therefore, If liabilities plus owner’s equity is equal to $300,000, then the total assets must also be equal to $300,000.

Impact of transactions on accounting equation

Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit).

Every transaction impacts accounting equation in terms of dollar amounts but the equation as a whole always remains in balance. Any increase in one side is balanced either by a corresponding decrease in the same side or by a corresponding increase in the other side and any decrease is balanced either by a corresponding increase in the same side or by a corresponding decrease in the other side. For better explanation, consider the impact of twelve transactions included in the following example:

Example 2:

Mr. John started a T-shirts business to be known as “John T-shirts”. He performed following transactions during the first month of operations:

- Mr. John invested a capital of $15,000 into his business.

- Acquired a building for $5,000 cash for business use.

- Bought furniture for $1,500 cash for business use.

- Purchased T-shirts from a manufacturer for $3,000 cash.

- Sold T- shirts for $1,000 cash, the cost of those T-shirts were $700.

- Purchased T-shirts for $2,000 on credit.

- Sold T-shirts for $800 on credit, the cost of those shirts were $550.

- Paid $1,000 cash to his payables.

- Collected $800 cash from his receivables.

- The shirts costing $100 were stolen by someone.

- Mr. John paid $150 cash for telephone bill.

- Borrowed money amounting to $5,000 from City Bank for business purpose.

Required: Explain how each of the above transactions impacts the accounting equation of John T-shirts.

Solution

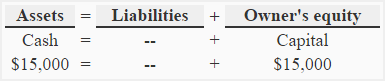

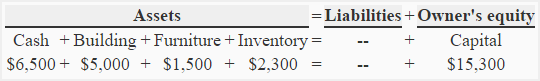

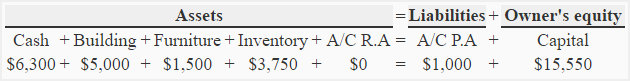

Transaction 1: The investment of capital by John is the first transaction of John T-shirts which creates very initial accounting equation of the business. At this point, the cash is the only asset of business and owner has the sole claim to this asset. Therefore, the equation would look like the following:

Equation element(s) impacted as a result of transaction 1: “Assets” & “Owner’s equity”.

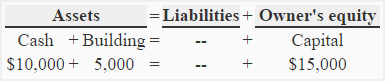

Transaction 2: The second transaction is the purchase of building which brings two changes. First, it reduces cash by $5,000 and second, the building valuing $5,000 comes into the business. In other words, cash amounting to $5,000 is converted into building. The impact of this transaction on accounting equation is shown below:

Equation element(s) impacted as a result of transaction 2: “Assets”

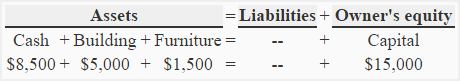

Transaction 3: The impact of this transaction is similar to that of transaction number 2. Cash goes out of and furniture comes in to the business. On asset side, The reduction of $1,500 in cash is balanced by the addition of furniture with a value of $1,500.

Equation element(s) impacted as a result of transaction 3: “Assets”

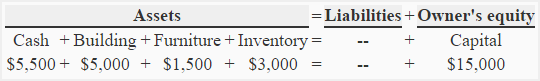

Transaction 4: The impact of this transaction is similar to transactions 2 and 3. One asset (i.e, cash) goes out and another asset (i.e, inventory) comes in. The cash would decrease by $3,000 and at the same time the inventory valuing $3,000 would be recorded on the asset side.

Equation element(s) impacted as a result of transaction 4: “Assets”

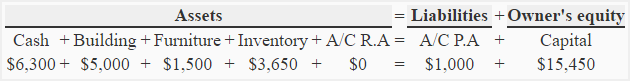

Transaction 5: In this transaction, shirts costing $700 are sold for $1,000 cash. It increases cash by $1,000 and reduces inventory by $700. The difference of $300 is the profit of the business that would be added to the capital. The whole impact of this transaction on accounting equation is shown below:

Equation element(s) impacted as a result of transaction 5: “Assets” & “Owner’s equity”

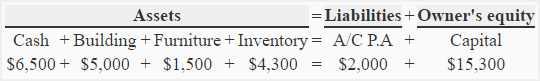

Transaction 6: In this transaction, T-shirts costing $2,000 are purchased on credit. It increases inventory on asset side and creates a liability of $2,000 known as accounts payable (abbreviated as A/C P.A) on the equity side of the equation. Since it is a credit transaction, it has no impact on cash.

Equation element(s) impacted as a result of transaction 6: “Assets” & “liabilities”

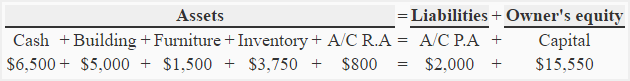

Transaction 7: In this transaction, the business sells T-shirts costing $550 for $800 on credit. It reduces inventory by $550 and creates a new asset known as accounts receivable (abbreviated as A/C R.A) valuing $800. The difference of $250 is profit of the business and would be added to capital under the head owner’s equity.

Equation element(s) impacted as a result of transaction 7: “Assets” & “Owner’s equity”

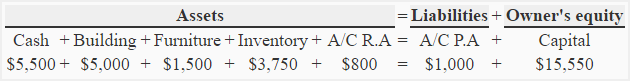

Transaction 8: In this transaction, business pays cash amounting to $1,000 for a previous credit purchase. It will reduce cash and accounts payable liability both with $1,000.

Equation element(s) impacted as a result of transaction 8: “Assets” & “Liabilities”

Transaction 9: In this transaction, the business collects cash amounting to $800 for a previous credit sale. On asset side, it increases cash by $800 and reduces accounts receivable by the same amount.

Equation element(s) impacted as a result of transaction 9: “Assets”

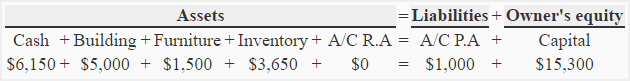

Transaction 10: The loss of shirts by theft reduces inventory on asset side and capital on equity side both by $100. All expenses and losses reduce owner’s equity or capital.

Equation element(s) impacted as a result of transaction 10: “Assets” & “Owner’s equity”

Transaction 11: The payment of telephone and electricity bills are business expenses that reduce cash on asset side and capital on equity side both by $150.

Equation element(s) impacted as a result of transaction 11: “Assets” & “Owner’s equity”

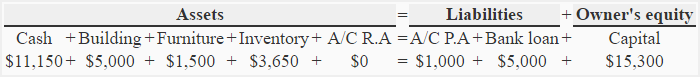

Transaction 12: The loan is a liability because the John T-shirts will have to repay it to the City Bank. This transaction increases cash by $5,000 on asset side and creates a “bank loan” liability of $5,000 on equity side.

Equation element(s) impacted as a result of transaction 12: “Assets” & “Liabilities”

In above example, we have observed the impact of twelve different transactions on accounting equation. Notice that each transaction changes the dollar value of at least one of the basic elements of equation (i.e., assets, liabilities and owner’s equity) but the equation as a whole does not lose its balance.

it was bit challenging but knowledge obtained.

This is nasir,please give me more questions and let me practice on it. Topic : accounting equatin

Excellent, I am so thankful for these explainations

It is informative and well presented. I need more examples.

I love this

Good explantions with examples, thanks buddy

Hi. I am a G11 student in this upcoming school year, thank you for the examples and a good explanation. I understand the topic more examples please.

Thank you for this concise take on the equation, your input and presentation is much appreciated. Good day