True variable and step variable costs

Generally, all variable costs are considered to have similar behavior in response to a change in their level of activity – their total dollar amount increases or decreases in direct proportion to the rise or fall in the level of business activities that drive them. This is true because this is the basic reason why we call a cost a variable cost. However, the pattern in which a variable cost behaves as its associated activity level alters may significantly differ from another variable cost. On the basis of this behavior pattern, we can bifurcate variable costs into two types – true variable and step variable costs.

Let’s briefly explain, differentiate and exemplify these two types of variable costs.

True variable costs

A true variable cost (also known as proportionately variable cost) may be defined as a cost whose total dollar amount increases or decrease in direct proportion to the change in the level of activity that drives the cost. In real manufacturing processes, only a few costs are truly or proportionately variable. The most common example of true variable cost is the cost of direct materials used in manufacturing processes. For example, you are a manufacturer of lead pencil sharpeners. Each sharpener you manufacture requires a small size stainless steel blade which costs you 20 cents per piece. Suppose you receive three orders from three different customers – one for 10,000 sharpeners, one for 20,000 sharpeners and one for 30,000 sharpeners. The cost of blades needed for producing these quantities can be computed as follows:

For manufacturing 10,000 sharpeners, you need 10,000 blades:

10,000 blades x $0.20

= $2,000

For manufacturing 20,000 sharpeners, you need 20,000 blades:

20,000 blades x $0.20

= $4,000

For manufacturing 30,000 sharpeners, you need 30,000 blades:

30,000 blades x $0.20

= $6,000

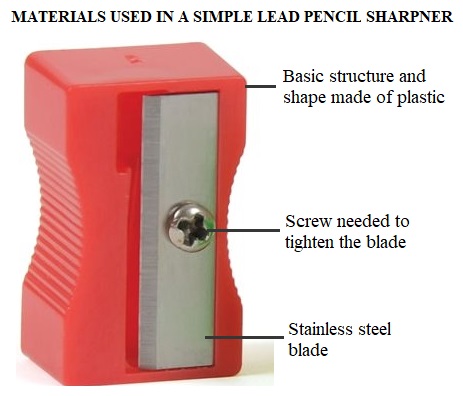

Because the blades’ cost has a direct one-to-one relation with your business’s production activity, it is an example of the true variable cost of your sharpener manufacturing business. Not only the stainless steel blades but other direct materials used to make other parts of a saleable sharpener, like plastic used to create the basic structure and shape and a small screw used to tighten the blade in its right place, would also exhibit a similar behavior towards the production activity of your business. The quantities and cost of these two materials would also increase in direct proportion, i.e., on a per-unit basis. For example, you would need one tightening screw to complete one sharpener and 10,000 screws to complete 10,000 sharpeners. Similarly, suppose if you need 25 grams of plastic to manufacture the basic structure and shape of one sharpener, you would need at least 250,000 grams of plastic to make 10,000 sharpeners.

A common characteristic of true variable costs is that the resources acquired by incurring them can be stored as inventory and carried forward to the next period. In your sharpener manufacturing business example, you can store any unused stainless steel blades, report them in balance sheet as materials inventory at the end of the period and use them to make more sharpeners in the next period.

Step variable costs

The step variable cost does not behave in exactly the same pattern as the true variable cost. Unlike a true variable cost, it does not respond to small changes in activity levels (such as an additional unit produced) but remains unchanged over a significantly wide range of business operation or activity. Once a certain activity level is reached, it jumps to the next level in terms of total dollar amount.

Let’s continue with the above example of your sharpener manufacturing business. If you need one worker to manufacture 10,000 sharpeners in a month, then the worker’s monthly wages would remain unchanged over a production range of one to 10,000 sharpeners. If you manufacture more than 10,000 sharpeners, say 11,000 pieces in a month, you would need to hire another worker and your wages cost would jump to its double. For making more than 20,000 sharpeners, say 22,000 pieces in a month, you would need to hire another worker and your total wage cost would be tripled. The wages of these direct labor workers, therefore, qualifies as a step variable cost of your sharpener manufacturing business.

If you hire an expert direct labor worker for a monthly wage of $1,000 in your industry, the total amount of your direct labor cost on various levels of production would be as follows:

(i). From 1 to 10,000 sharpeners in a month:

= $1,000 x 1 worker

= $1,000

(ii). From 10,001 to 20,000 sharpeners in a month:

= $1,000 x 2 workers

= $2,000

(iii). From 20,001 to 30,000 sharpeners in a month:

= $1,000 x 3 workers

= $3,000

The resources acquired against step variable costs can’t be stored as inventory. In above example, if you don’t use the time of a direct labor worker effectively, you would not be able to store it as inventory for use in a later period. The unused time resource would be gone forever.

TRUE VARIABLE COST VS STEP VARIABLE COST

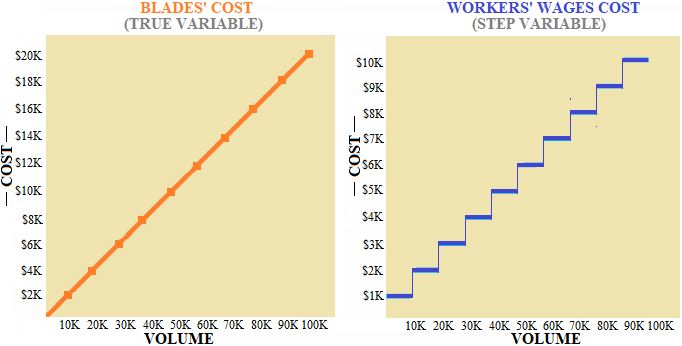

The following exhibit illustrates the behavior pattern of both true variable and step variable costs. Notice that the wages’ cost, which is a step variable cost in our example, remains constant up to a certain quantity of sharpeners produced and then jumps to the higher level. At higher level, it again remains constant until the completion of a certain volume of output and then jumps to the next higher level.

In a business, it might be possible to convert some step variable costs to true variable costs. For example, if you can manage to hire direct labor workers at a wage of one cent per piece rather than at a fixed monthly wage of $1,000, then your direct labor cost would directly respond to each additional sharpener manufactured and, therefore, would become a true variable cost. Similarly, a labor related true variable cost might also be possibly converted to a step variable cost.

Leave a comment