Step down method of cost allocation

Unlike direct method, the step method (also known as step down method) allocates the cost of a service department to other service departments as well as to operating departments. The cost allocation under step method is a sequential process. It begins with the allocation of cost of the service department that provides the greatest amount of service to other service departments and ends with the allocation of cost of the service department that provides the least amount of service to other service departments.

Example

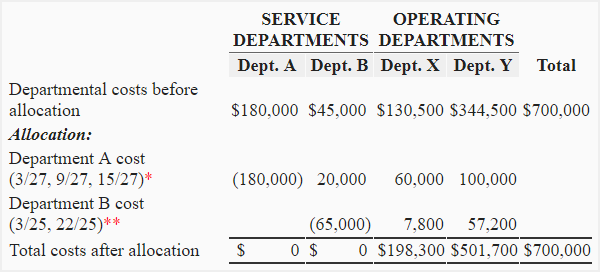

The Robert Company uses the step method for allocating the costs of its service departments to operating departments. The company has two service departments and two operating departments. The selected information for the four departments is given below:

The company uses employee hours as the base for allocating the cost of department A and space occupied for allocating the cost of department B.

Required: Allocate the cost of service departments to operating departments using step down method.

Solution

Allocation of department A’s cost:

Allocation ratio:

Department B: 3,000/(3000 + 9000 + 15,000 ) = 3,000/27000 or 3/27

Department X: 9,000/(3000 + 9000 + 15,000 ) = 9,000/27000 or 9/27

Department Y: 15,000/(3000 + 9000 + 15,000 ) = 15,000/27000 or 15/27

Allocated to department B: $180,000 × (3/27) = $20,000

Allocated to department X: $180,000 × (9/27) = $60,000

Allocated to department Y: $180,000 × (15/27) = $100,000

Allocation of department B’s cost:

Allocation ratio:

Department X: 3,000/(3,000 + 22,000) = 3,000/25,000 or 3/25

Department Y: 22,000/(3,000 + 22,000) = 22,000/25,000 or 22/25

Total cost of department B: $45,000 + $20,000 = $65,000

Allocated to department X: $65,000 × (3/25) = $7,800

Allocated to department Y: $65,000 × (22/25) = $57,200

Important points to remember

Consider the following important points regarding the above example of cost allocation under step method:

- You can see two steps of cost allocation. In first step, the cost of department A has been allocated to other service department (department B) as well as to operating departments (department X and Y). The allocation base of department A has been ignored.

The allocation base of a service department whose cost is being allocated to other departments is always ignored under both step down and direct method of cost allocation. - In second step, the total cost of department B ($45,000 + $20,000 = $65,000) has been allocated to department X and Y. No portion of department B’s cost has been allocated to department A.

The allocation base of a service department whose cost has already been allocated to other departments is ignored under step method of cost allocation.

Example 2

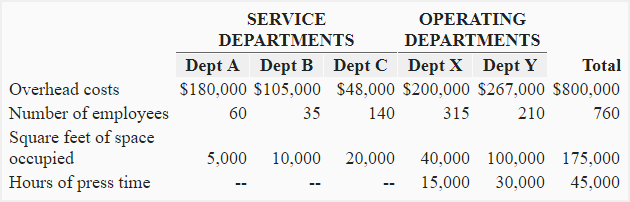

The Michigan Company provides the following selected data about its three service and two operating departments:

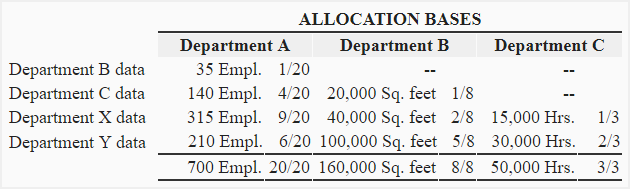

The order and bases for allocating service department costs is given below:

- Department A; allocation base is “number of employees”.

- Department B; allocation base is “space occupied”.

- Department C; allocation base is “hours of time”.

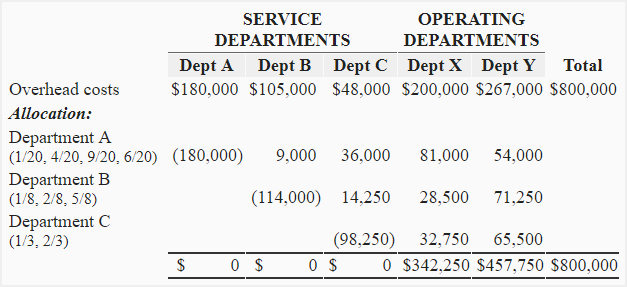

Required: Allocate the cost of service departments to operating departments using step down method of cost allocation.

Solution

Leave a comment