Direct method of cost allocation

The direct method is considered the most simple method of allocating the cost of service departments to operating departments. Under this method, the costs incurred by service departments are not allocated to each other; rather, they are directly allocated to operating departments using some appropriate allocation base. In other words, we can say that the direct method of departmental cost allocation ignores the service provided by a service department to itself and to other service departments.

Suppose, for example, a company has four departments – department A, department B, department C and department D. The departments A and B are service departments whereas departments C and D are operating departments. If the direct method of cost allocation is used, the cost incurred by department A and department B would be allocated to department C and department D only. The cost of department A and department B would not be allocated to each other even if the two departments provide a significant amount of service to each other.

Example

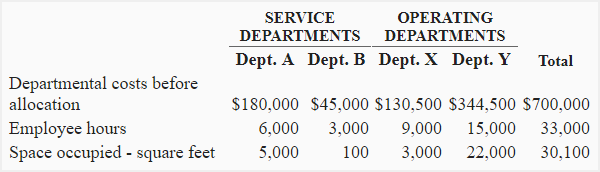

The Murphy Company has two service departments and two operating departments as shown below:

The two service departments provide service to each other as well as to operating departments. The department A’s cost is allocated on the basis of employee hours and department B’s cost is allocated on the basis of square feet occupied.

Required: Allocate the cost of service departments to operating departments using direct method of cost allocation.

Solution

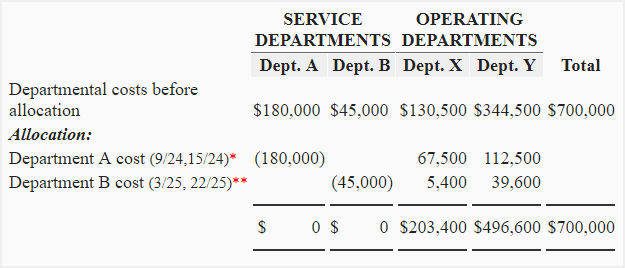

*Department A’s cost has been allocated on the basis of employee hours:

9,000 hours + 15,000 hours = 24,000 hours.

Allocated to department X: $180,000 × (9/24) = $67,500

Allocated to department Y: $180,000 × (15/24) = $112,500

**Department B’s cost has been allocated on the basis of spaces occupied:

3,000 square feet + 22,000 square feet = 25,000 square feet.

Allocated to department X: $45,000 × (3/25) = $5,400

Allocated to department Y: $45,000 × (22/25) = $39,600

Important points to remember:

You should note the following two important points regarding the cost allocation given in the above example:

- The amount of allocation base that is attributable only to operating departments has been used under direct method of departmental cost allocation. Any allocation base attributable to service departments themselves has been ignored. Notice, that both department A and department B (service departments) have recorded some employee hours but nothing from department A’s cost has been allocated to them. Similarly, both the departments occupy some space but it has been ignored while allocating the cost of department B.

- After allocating the whole cost of service departments to operating departments, the final cost of operating departments would be used to compute overhead rates for the purpose of costing products manufactured or services provided by the operating departments.

Advantages and disadvantages of direct method of cost allocation

Many organizations use direct method for allocating departmental costs because it is very simple and easy to employ.

The major disadvantage of direct method is that it ignores interdepartmental services and can, therefore, lead to distorted products and services cost. Moreover, it is commonly considered a less accurate method when compared with other methods available for departmental cost allocation.

Leave a comment