Revaluation method of depreciation

Revaluation method of depreciation is one of the easiest ways of calculating depreciation on fixed assets. The value of the asset on which depreciation charge is to be calculated is assessed both at the start and at the end of the year and any revaluation losses arisen during the year are considered as the depreciation charge. The valuation is usually performed by either an internal competent member of the entity or an external professional valuer.

Revaluation method of depreciation is mostly used for the calculation of depreciation of trivial, inexpensive and small fixed assets that are normally accounted for as a collective unit. This method makes the calculations easier, because it is usually much complicated and time consuming to assess depreciation of each of such assets separately.

What is revaluation and revaluation loss?

The assessment of the value of an asset or liability for the purposes of adjustment in the carrying value of an asset or liability. This task is usually performed at the end of the financial period or year and relevant entries are made.

If at the end of the financial year there is a decline in the price of an asset e.g. the carrying amount of the asset is higher than its recoverable amount, this is accounted for as a ‘revaluation loss’ and the value of the asset is decreased by that amount to depict the true value of that asset.

Formula:

The formula for computing depreciation expense under revaluation method is given below:

Depreciation expense = Value of asset at the start of the year + Additions during the year – Deductions during the year – Value of asset at the end of the Year

Example 1

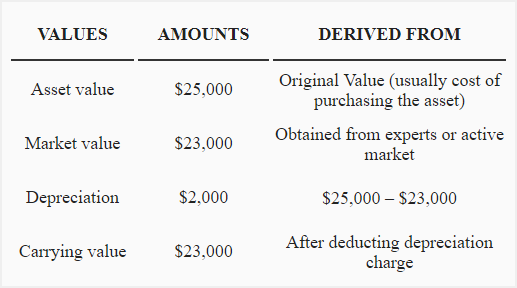

A company has certain equipment in use worth $25,000. At the end of the year, the recoverable amount of asset decreases to $23,000. The amount of the depreciation to be charged will be the difference between the two values.

Example 2

A company owns a pool of many small assets costing $132,000. During the financial year, the additions to this pool of assets is $48,000. So, collectively the value of pool is $(132,000 + 48,000) $180,000. The revalued amount of the pool at the end of the year is $164,000.

Depreciation Charge = $(180,000 – 164,000)

= $16,000

Example 3

A business maintains a pool of assets of carrying value $33,000. During the year, the assets amounting to $8,000 get stolen/damaged/obsolete and at the end of the year the revalued amount of the assets is $24,000. In this case the depreciation will be:

Depreciation Charge = ($33,000 – $8,000) – $24,000

= $1,000

Advantages and disadvantages of revaluation method of depreciation

The major advantages and disadvantages of revaluation method of depreciation are given below:

Advantages:

- The method is very simple and straightforward to understand.

- This method could be applied to a variety of assets upon which assessment of inflow of financial benefits individually could not be estimated easily.

- Where a business has many small assets, this method could be applied to all the assets collectively, assuming all the smaller assets as one big asset.

Disadvantages:

- It may be the case that the asset could not be revalued every year or the cost of the asset may not decline. In such a case, no depreciation could be charged on the asset.

- The sum of depreciation that is charged to the assets does not show a steady pattern.

- The implementation of this method could become costly as revaluation exercise requires assistance from experts which sometime results in cost exceeding its benefit.

- The revaluation is a judgmental area and the amount of depreciation to be charged depends upon it. So, if the revaluation is not carried accordingly, the amount of depreciation charge could be miscalculated.

Leave a comment