Depletion method of depreciation

Depletion method of depreciation is mostly used by the companies that have assets that are natural resources like oil, gas, coal, mines, quarries or other wasting assets.

This method is named as ‘depletion method’ because the reduction of a natural resource or asset is known as depletion of that resource or asset and thus is used to depreciate assets that are natural resources. Such assets are also referred as wasting assets because their value deteriorates with the increasing extraction of resources. For example in case of a coal mine, more the coal is extracted more will be the depletion of the mine etc.

Formula

There are three steps involved in computation of depreciation under depletion method.

Step 1: Determination of the depletion base:

The depletion base comprises of cost incurred to acquire or lease the asset, exploration cost, development cost and any cost incurred to restore the property to its original condition after the assets or resources have been fully depleted.

Step 2: Computation of depletion rate per unit:

The depletion rate per unit of a natural resource or asset depends upon the total number of units expected to be extracted. This is calculated by dividing the depletion base less salvage value (if any) by the number of units expected to be extracted.

Depletion rate = (Depletion base – Salvage value)/Total units expected to be extracted

Step 3: Computation of depletion/depreciation charge:

Finally, the units extracted during the period are multiplied by the depletion rate per unit to compute the depletion or depreciation charge for the period.

Depletion charge for the period = Units extracted during the period × Depletion rate

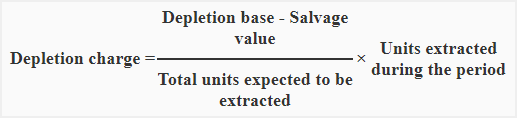

The above three steps can be combined together to make the following formula for computing depletion or depreciation charge for a particular period:

Example 1 – Simple computation of depletion charge

The Michigan Mining Company has acquired a coal mine for a cost of $4,500,000. No other costs are involved. The total coal expected to be extracted from the mine is 35,000 tons. During the year 2018, the total extraction of coal is 5,700 tons. There is no salvage value.

Required: Using the above information compute:

- the depletion rate per tone of coal extracted.

- the depletion charge of the coal extracted during the year 2018.

Solution

- Depletion base = $4,500,000

- Expected coal to be extracted = 35,000 tons

1. Depletion rate:

Depletion base/Expected coal to be extracted

= $4,500,000/35,000 tons

= $128.5714

2. Depletion charge:

Coal extracted during the period × Depletion rate

= 5,700 tons × $128.5714

= $732,849

or

(Depletion base/Expected coal to be extracted) × Coal extracted during the period

= ($4,500,000/35,000 tons) × 5,700 tons

= $732,849

Example 2 – Salvage value and restoration cost

A furniture company buys a forest to obtain wood for manufacturing furniture. The related costs to the forest are:

- Cost of buying the forest = $730,000,000

- Wood expected to be extracted = 400,000 ton

- Cost of restoration of the forest = $120,000,000

- Residual/salvage value = $233,000,000

- Trees cut in year 1 = 107,000 tons

- Trees cut in year 2 = 89,000 tons

Solution

- Depletion Base = (cost of acquisition + cost of restoration)

= $730,000,000 + $120,000,000

= $850,000,000 - Expected wood to be extracted = 400,000 ton

Depletion rate:

(Depletion base – Salvage value)/Expected wood to be extracted

= (850,000,000 – 233,000,000)/400,000 tons

= $1,542.5

Depletion charge for year 1:

Wood extracted during the period × Depletion rate

= 107,000 tons × $1,542.5

= $165,047,500

Depletion charge for year 2:

Wood extracted during the period × Depletion rate

= 89,000 tons × $1,542.5

= $137,282,500

Change in expected units

The depletion rate largely depends on the number of expected output. A change in expected units to be extracted may therefore have a significant impact on both depletion rate and depletion charge for future periods. Where the extraction process has already been started and a revised survey changes the expected output, a new depletion rate is worked out and used for computing the depletion charge for the future periods. Consider the following example to understand this process:

Example 3 – Change in estimates:

The GAMA Company leases a stone quarry for an amount of $79,000,000. The estimated extraction of minerals at the start of year 1 is 250,000 tons. The actual annual output from the quarry for the first three years of operation is given below:

- Year 1: 50,000 tons

- Year 2: 60,000 tons

- Year 3: 65,000 tons

At the start of the year 2, a new survey is conducted and it is found that the expected extraction of minerals is only 160,000 tons (i.e.,40,000 tons less then the original estimate). The company decided to workout a new depletion rate on the basis of information provided by revised survey.

Required: Using above information, compute the depletion charge for first three years of GAMA Company.

Solution

- Depletion base = $79,000,000

- Tons expected to be extracted = 250,000 tons

- Depletion rate: $79,000,000/250,000 tons = $316 per ton

Depletion charge for year 1:

Depletion charge: 50,000 tons × $316 = $15,800,000

As the estimated output has changed as a result of new survey conducted at the start of year 2, we must compute a new depletion rate to be used for year 2 and year 3.

- Depletion base: $79,000,000 – $15,800,000 = $63,200,000

- Tons expected to be extracted = 160,000 tons

- Depletion rate: $63,200,000/160,000 tons = $395

Depletion charge for year 2:

Depletion charge: 60,000 tons × $395 = $23,700,000

Depletion charge for year 3:

Depletion charge: 65,000 tons × $395 = $25,675,000

Advantages and disadvantages of depletion method

Some advantages and disadvantages of depletion method of depreciation are given below:

Advantages:

- It provides a method to charge amortization/depreciation for the companies dealing in natural resources, as these assets are different in nature and consumption from other fixed assets like car, building, equipment etc.

- The method itself is easy to understand and apply.

Disadvantages:

- The method is simply used for a periodic reduction in the cost of the asset and it is unlikely that the carrying amount of the asset shows the real market value of the asset.

- The method is highly subjective; especially, the number of units to be extracted in many cases is difficult to estimate.

Leave a comment