Petty cash book

Besides maintaining a main or general cash book, many companies also maintain a small cash book, known as the petty cash book. The purpose of a petty cash book is to record the small day-to-day expenditures of the business.

A petty cash book is a type of cash book that is used to record minor regular expenditures such as office teas, bus fares, fuel, newspapers, cleaning, pins, casual labor, etc. These small expenditures are usually paid for using coins and currency notes rather than checks. The person responsible for spending petty cash and recording it in a petty cash book is known as the petty cashier.

The chief cashier (also known as the head or main cashier) bears the heavy responsibility of maintaining the company’s general cash book, in which receipts and payments amounting to hundreds or even thousands of dollars are recorded by him every day. He, therefore, usually delegates the responsibility of handling small day-to-day cash transactions to a bookkeeper, receptionist, or some other reliable staff member. Like a general cash book, a petty cash book has a debit and a credit side. All receipts are recorded on the debit side, and all payments are recorded on the credit side of the petty cash book by the petty cashier.

Petty cash systems

The amount of cash allocated for petty expenditures for a specific period is entered on the credit side of the general cash book and on the debit side of the petty cash book.

The cash is handed over to the petty cashier either on an ordinary system or an imprest system. These two systems are briefly explained below:

1. Ordinary system

Under the ordinary system, a lump sum amount of cash is given to the petty cashier. When the whole amount is spent, the petty cashier submits the details of petty expenditures recorded in the petty cash book to the head or chief cashier for review.

2. Imprest system

Under the imprest system, a fixed amount of money known as the “float” is given to the petty cashier to meet petty expenditures for an agreed period, which usually consists of a week or month. At the end of the agreed period, the petty cashier submits the details of all expenditures incurred by him to the chief cashier. The total cash spent by the petty cashier during the period is reimbursed to him, and the total cash available to spend at the start of the next period becomes equal to the original sum (i.e., a float). At any time, the total of the petty cash balance and all expenditures that have not been reimbursed to the petty cashier is equal to the agreed float.

Advantages of imprest system:

The imprest system of petty cash is used by most of the companies because of the following advantages:

- The imprest system reduces the chances of misuse of cash because the float can be immediately reduced if it is found to be more than adequate for the agreed period.

- Under this system, the chief cashier periodically checks the record of petty cash. If an error is committed by the petty cashier, it can be detected and rectified soon.

- It saves the time of the firm’s chief cashier, who is usually a busy person with heavy responsibilities of handling large receipts and payments by cash and checks.

- The imprest system enables significant savings to be effected by posting small items to accounts in the ledger since it uses an analysis system that collects small items together into weekly or monthly totals.

- This system trains young staff members in handling cash with responsibility.

- There is little to no chance of misappropriation of cash by the person in charge because the imprested sum is usually very small.

Format of petty cash book

A simple format of petty cash book is given below:

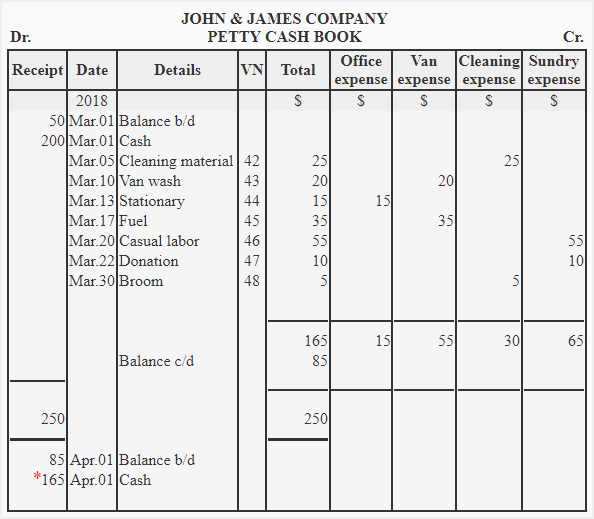

Example

The petty cashier of John and James Company paid cash for the following expenditures during March 2018.

- March 01: Balance brought forward; petty cash $50.

- March 01: The amount of petty expenditures for previous moth reimbursed by chief cashier $200.

- March 05: Bought some liquid material for cleaning purpose $25.

- March 10: Paid $20 for van wash.

- March 13: Bought pens and pencils $15.

- March 17: Paid for fuel $35.

- March 20: Paid $55 for casual labor.

- March 22: Donated $10 to SBA – a charitable institution.

- March 30: Bought a broom for office $5

Required: Record the above transactions in a petty cash book, assuming a petty cash imprest system is used and the monthly fixed float is $250.

Solution

*Cash reimbursed to restore the monthly float:

The amount of the fixed monthly float is $250, and the balance after petty expenses is $85. Therefore, the cash amounting to $165 has been added as reimbursement to the balance to restore the fixed monthly float of $250.

Fixed monthly float: $250

Petty cash balance: $85

Amount needed to restore the monthly float:

= $250 – $85

= $165

Also notice that on March 1, the cash amounting to $200 was added to the balance of $50 to restore the float.

Good

Very good

Please are you a Business student.

Yes , please 😊😊😊😊😊

Danielle can u pronounce ur name 4 me I don’t know how to pronounce it

The Explanation is easy to Understand

Where did you get the 85 to add to the 165?

(Balance b/d on March 01 + Cash received on March 01) – Cash spent during March

= ($50 + $200) – $165

= $85

I understood thank you

Yes I don’t understand too

Where does 85 came from and help me to explain what is VN

VN is voucher number and 85 is the balance brought down to equalise it with the float which is 250

Me too. It’s not like the one I know 😕

I need more help I didn’t understand please post examples

Read it now

Sorry please why do we bring the cash down 165

Thank you

Thanks for this, you are doing a wonderful job Sr,

please why not shown clearly on the table the balance b/d for a better understanding

where did the 85 come from

Good

Thanks for this but please you know that the 165 is the total expenses that we spent for the month of march please why are we still going to bring it back as cash for the month of April please

Remember, fixed monthly float is 250$., balance after expenses is 85$.

therefore, 165$ is added as reimbursement to balance of 85$ to amount fixed monthly float of 250$

More elaboration in terms of balance and receipt

What if the total expenditure is more than the monthly cash float. What are we supposed to do?

Good lesson.

I am interest to this informations about accounting.

Hello

Do u no jetbits app on gogle