Operating ratio

Operating ratio (also referred to as operating cost ratio) is computed by dividing the total of cost of goods sold (COGS) and operating expenses by the net sales revenue for a specific period. This ratio indicates how efficient an entity has been in controlling its total operating cost during the period concerned. Like individual expense ratios, this ratio is also communicated in percentage.

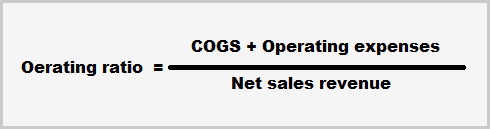

Formula:

Operating ratio is computed as follows:

The three components of the formula are cost of goods sold (COGS), operating expenses and net sales. The numerator consists of the total of COGS and operating expenses whereas the denominator consists of the net sales revenue. Generally, all these numbers can be taken from the entity’s published income statement.

Since the ratio is primarily concerned with the operating performance of an entity, the non-operating expenses such as interest charges and income tax etc. are not taken into account.

The following example may be helpful in understanding the computation of operating ratio:

Example:

The selected data from the records of Good Luck Company limited is given below:

- Gross sales: $420,000

- Sales returns: $20,000

- Cost of goods sold: $160,000

- Administrative expenses: $35,000

- Selling expense: $25,000

- Interest charges: $10,000

Required: Compute operating ratio for Good Luck Company Limited from the above data.

Solution:

= (220,000*/400,000**) × 100

= 55%

The operating ratio is 55% which means 55% of the sales revenue would be used to cover cost of goods sold and operating expenses of Good Luck Company Limited. The remaining 45% of the revenue would be available to first cover non-operating expenses (like interest on debt and income tax etc.) and then provide for profit.

*Total of COGS and operating expenses:

= COGS + (Administrative expenses + Selling expenses)

= $160,000 + ($35,000 + $25,000)

= $160,000 + $60,000

= $220,000

**Net sales:

= Gross sales – Sales returns

= $42,000 – $20,000

= $400,000

Notice that the interest charges of $10,000 have not been considered in computation because they are categorized on income statement as financial expenses, not operating expenses.

Significance and interpretation:

The operating ratio is used to measure the operational efficiency of a company’s management. It shows whether or not the cost component in the revenue number is within the normal range.

A low operating ratio means the entity’s cost of goods sold and operating expenses are leaving a larger portion of revenue as operating profit which may eventually be translated into a higher net profit number. The reverse, on the other hand, is true for a high operating ratio.

For the purpose of analysis, this ratio can be compared with the company’s own past years’ ratio as well as the ratio of other similar companies. An increase in the ratio should be investigated and brought to the attention of management as soon as possible so that corrective steps can be taken.

The operating ratio varies from industry to industry; hence, the firms selected for performance comparison must belong to the same industry.

Leave a comment