Market value or reversal cost method of costing by-products

Explanation of the method

The market value method (also known as reversal cost method) of costing by-products is identical to the recognition of gross revenue method of costing by-products. Both the methods reduce the production or manufacturing cost of the main product by the value of by-product.

Under recognition of gross revenue method, the production cost of the main product is reduced by the actual revenue realized from the sale of by product. However, the market value or reversal cost method reduces the production cost of the main product by the estimated value of the by-product at time of recovery or split-off point.

An account usually titled as “by-product account” is charged with the estimated value at the time of recovery (i.e., split-off point) and the cost of main product is credited. The materials, labor or factory overhead costs incurred on the by-product after split-off point is charged to the by-product. Any marketing or administrative costs belonging to the by-product may also be allocated to it.

The balance of the by-product account can be shown on the income statement using one of the four approaches described in recognition of gross revenue method of costing by-products.

The manufacturing cost that is applicable to any unsold inventory of by-product is presented on the balance sheet.

Example

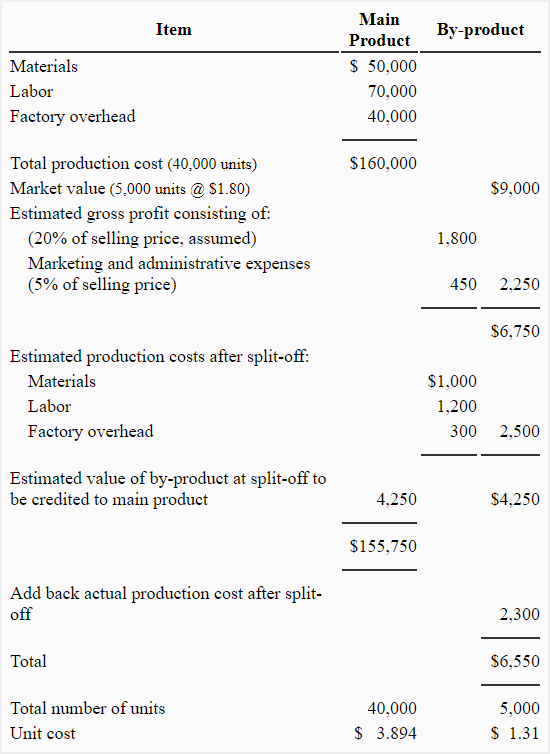

The following example illustrates the market value or reversal cost method of costing by products:

The above example shows that the by-product’s estimated value at split-off point is obtained by deducting the estimated gross profit and production cost after split-off point from the ultimate market value of the by-product.

Where the by-product has a market value at the time of recovery or split-off point, the by-product account is charged with that value less the estimated amount of gross profit. The offsetting credit goes to the production cost of the main product.

Reversal cost method assumes that the cost of a by-product is related to its sales value. The market values of the main product and the by-product at split-off point can also be used as the basis for allocating a share of joint production cost to the by-product and applying the offsetting credit to the main product’s production cost. Under this approach, the by-product is treated just like a joint product.

Leave a comment