Exercise-1 (Unit product cost under variable and absorption costing)

Learning objectives:

This exercise illustrates the computation of unit product cost under variable and absorption costing. It also points out why the amount of unit product cost under two costing systems differs.

Super Bike Manufacturing Company presents the following data for year 2022:

- Opening inventory: 0 units

- Sales: 8,000 units

- Production: 10,000 units

- Closing inventory: 2,000 units

- Direct materials: $240

- Direct labor: $280

- Variable manufacturing overhead expenses: $100

- Variable selling and administrative expenses: $40

- Fixed manufacturing overhead expenses: $1200,000

- Fixed selling and administrative expenses: $800,000

Required: Using the data given above, compute the unit product cost of one bike under:

- absorption costing system.

- variable costing system.

Solution:

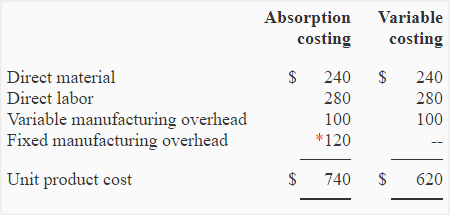

Computation of unit product cost under variable and absorption costing:

*Per unit fixed manufacturing overhead:

Fixed manufacturing overhead/No. of units manufactured

= 1,200,000/10,000

= $120

The cost to manufacture one bike is $740 under absorption costing system and $620 under variable costing system.

Notice that the fixed manufacturing overhead cost has not been included while computing the cost of one bike under the variable costing system. This is because, under variable costing, fixed manufacturing overhead is a period cost, not a product cost.

Note for students:

Selling and administrative expenses (both variable and fixed) are not relevant for the computation of unit product cost because these expenses are treated as period costs under both costing systems.

hey when calculating for variable overhead is it not cost over unit? it so why is the answer not 0.01 instead of 100