Double column cash book

The double-column cash book (also known as the two-column cash book) has two money columns on both debit and credit sides – one to record cash transactions and one to record bank transactions. In other words, we can say that if we add a bank column to both sides of a single-column cash book, it would become a double-column cash book. The cash column is used to record all cash transactions and works as a cash account, whereas the bank column is used to record all receipts and payments made by checks and works as a bank account. Both the columns are totaled and balanced like a traditional T-account at the end of an appropriate period, which is usually one month.

Since a double-column cash book provides cash as well as bank balance at the end of a period, some organizations prefer to maintain a double-column cash book rather than maintaining two separate ledger accounts for recording cash and bank transactions.

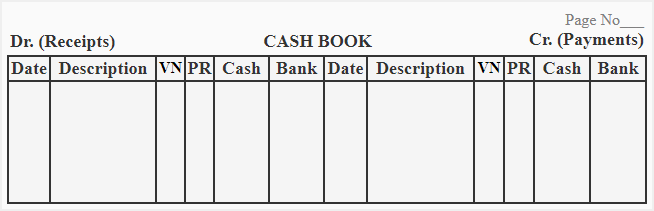

Format

The format/specimen of a double column cash book is given below:

The format of a double-column cash book given above has six columns on both debit and credit sides. The purpose of cash and bank columns has already been explained at the start of this article. The purpose of the date, description, voucher number (VN), and posting reference (PR) columns has been explained in the single-column cash book article.

Important points to remember while making entries in a double column cash book

Recording cash transactions:

- All cash receipts are recorded in the cash column on the debit side, and all cash payments are recorded in the cash column on the credit side of the double-column cash book.

- If cash is received from a debtor or customer and is deposited into the bank account on the same date, the entry will be made in the bank column on the debit side, not in the cash column.

Recording bank transactions:

- When a check is received and deposited into the bank account on the same date, the amount of the check is entered in the bank column on the debit side.

- When a check is received and the same is not deposited into the bank on the same date, the amount of the check is entered in the cash column, not in the bank column.

- When a check received from a receivable on a date subsequent to its receipt is deposited into the bank account, the entry is made in the bank column on the debit side and in the cash column on the credit side. It is called a contra entry.

- When a check is issued, the amount of the check is entered in the bank column on the credit side.

Recording contra entries:

“Contra” is a Latin word that means against or opposite. The contra entry is an entry that involves a cash account and a bank account and which is recorded on both debit and credit sides of the double-column cash book at the same time. This entry is not posted to any ledger account because both debit and credit aspects of the transaction are handled within the cash book and the double entry work is completed. In posting reference column, the letter “C” is written to denote that the entry is a contra entry and will not be posted to any ledger account. A contra entry is made in the following circumstances:

(1). When cash is deposited into the bank account:

The entry for depositing cash into the bank account is:

Bank [Dr]

Cash [Cr]

The deposited amount is written in the bank column on the debit side and the cash column on the credit side.

(2). When cash is withdrawn from bank account for business use:

The entry for withdrawal of cash from a bank account for business purposes is:

Cash [Dr]

Bank [Cr]

The withdrawn amount is written in the cash column on the debit side and the bank column on the credit side.

Important:

The contra entry is made only when the cash is withdrawn for business use. If cash is withdrawn for personal use, it will be recorded only in the bank column on the credit side of the cash book.

(3). When a check received from a receivable or customer on a date subsequent to its receipt is deposited into the bank account:

When a check is received and is not deposited into the bank account on the same date, it is recorded in the cash book just like a normal cash receipt. On a subsequent date, when the check is deposited into the bank account, the following entry is made:

Bank [Dr]

Cash [Cr]

The amount of the check is recorded in the bank column on the debit side and the cash column on the credit side.

Balancing and posting a double column cash book

Both the cash column and bank column of the double-column cash book are totaled and balanced at the end of an appropriate period. The process of balancing and posting a cash book has been explained in detail in a single-column cash book article. The same process is also applicable to a double-column cash book.

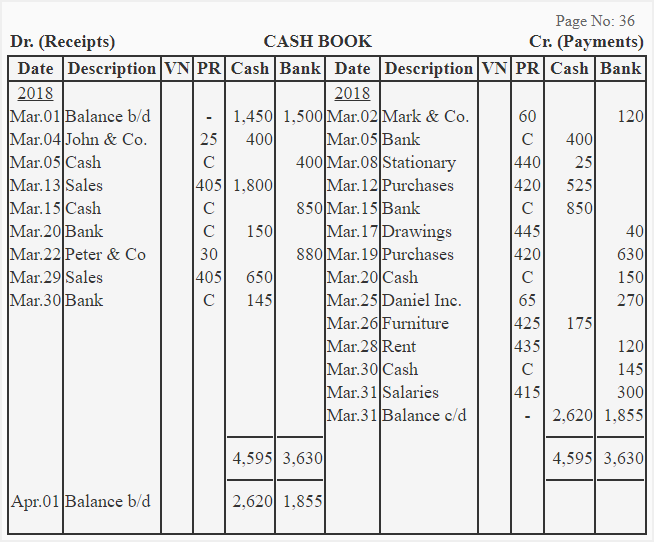

The following example summarizes the whole explanation given above.

Example

Edward Company uses a double-column cash book to record its cash and bank-related transactions. It engaged in the following transactions during March 2018:

- March 01: Cash balance $1,450 (Dr.), bank balance $1,500 (Dr.).

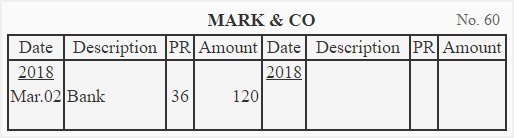

- March 02: Paid Mark & Co. by check $120.

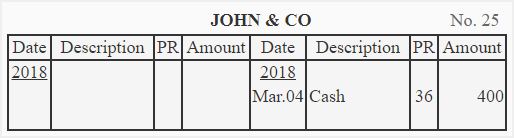

- March 04: Received from John & Co. a check amounting to $400.

- March 05: Deposited into bank the check received from John & Co. on March 04.

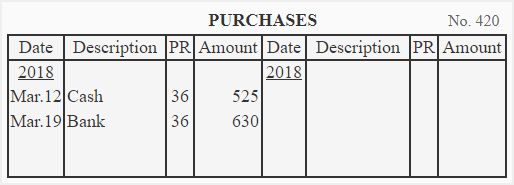

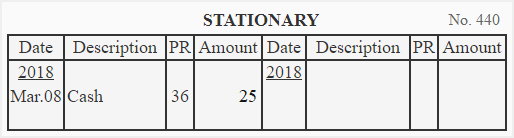

- March 08: Purchased stationary for cash, $25.

- March 12: Purchased merchandise for cash, $525.

- March 13: Sold merchandise for cash, $1,800.

- March 15: Cash deposited into bank, $850.

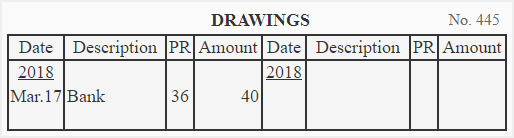

- March 17: Withdrew from bank for personal expenses, $40.

- March 19: Issued a check for merchandise purchased, $630.

- March 20: Drew from bank for office use, $150.

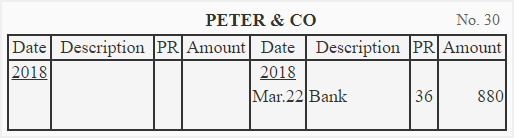

- March 22: Received a check from Peter & Co. and deposited the same into bank immediately, $880.

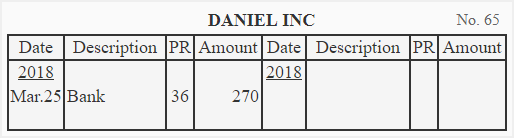

- March 25: Paid a check to Daniel Inc. for $270.

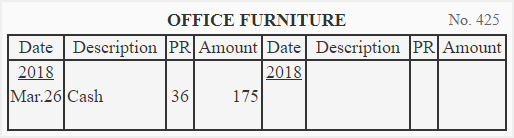

- March 26: Bought furniture for cash for office use, $175.

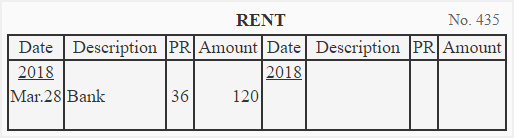

- March 28: Paid office rent by check, $120.

- March 29: Cash sales, $650.

- March 30: Withdrew from bank for office use, $145.

- March 31: Paid salary to employees by check, $300.

Required: Record the above transactions in a double-column cash book and post entries therefrom into relevant ledger accounts.

Solution

Cash book:

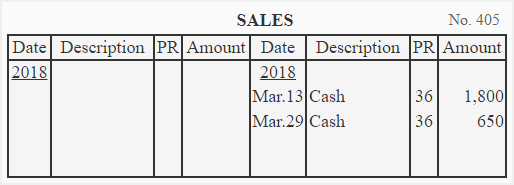

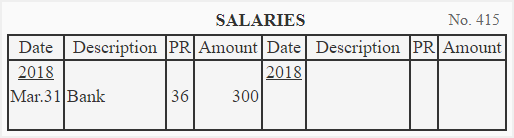

General ledger:

Accounts receivable subsidiary ledger:

Accounts payable subsidiary ledger:

Good morning please l want to asked how will loans be treated in these double column cash book. Thanks

Capture them under payments and in the discription put loan disbursement with the customer’s name. Eg Loan disbursement-Bih Loveline

How, plz put me through

Any transaction that involves credit or loans won’t be treated in the double system cash or in the cash book generally

easy

it is very simple

Nice information.

Kindly Correct spelling of ‘cheque ‘:)

Rgds

Cheque

A cheque is an order written by the drawer to a bank to pay on demand a specified sum of money to the person named as payee on the cheque.

thanks for your kindness

Thanks alot. But how do we treat discount allowed and received in the cashbook and why

Discounts are for three column cashbook. You create a column for discount allowed on Debit side, and a column for discount received on the credit side.

What are statements

I wanted to know how loan is recorded and also how are we recording when someone purchases a machinery to khamis on credit basis. Thanks

So interesting and Great

Well explained

Nice notes

Now can we make trial balance?

Make this solution with real balance

Thank you so much

excellent

How will you be able to open a cashbook

How will you be able to open a cashbook

Mm

Mm

Sure

How much will it be

Thanks but spelling of cheque needs to be revised

Wanted to know how stock is recorded.

jhon & co. is wrong in cash book you put in cash coloumn it wil recorded in bank coloumn

@BAGHEL

If a check is not deposited into bank the same day as it is received, we initially enter the amount in cash column. Subsequently, when the check is deposited, we make a contra entry.

How do we include Bank Charges

Do we include Bank Charges

I need how to manage the two columns cash book through understandable way. In my side I need help from you people and things,I don’t understanding some of Examples.

If a question says that sold goods 400,000 and it does not say either cash or bank account

When a cash withdrawal is done for personal use, how do we record it?

Why is it that under general ledger, purchases are written on debit side

I don’t get the formula for general ledger

I got a Rs. 1000 from the government to my office account on the 1st day of a month. I withdrew Rs. 500 from it on the 5th of that month and made an official purchase. How will it be recorded? The cash entry will have to be submitted for audit.

It’s very helpful and understandable

It will be on the debit side

Yes

Please errors should be corrected. nice work.

Thanks so much now i understand better