Capital gearing ratio

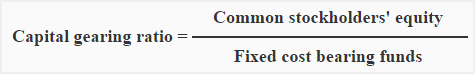

Capital gearing ratio is a useful tool to analyze the capital structure of a company and is computed by dividing the common stockholders’ equity by fixed interest or dividend bearing funds.

Analyzing capital structure means measuring the relationship between the funds provided by common stockholders and the funds provided by those who receive a periodic interest or dividend at a fixed rate.

A company is said to be low geared if the larger portion of the capital is composed of common stockholders’ equity. On the other hand, the company is said to be highly geared if the larger portion of the capital is composed of fixed interest/dividend bearing funds.

Formula:

In the above formula, the numerator consists of common stockholders’ equity that is equal to total stockholders’ equity less preferred stock and the denominator consists of fixed interest or dividend bearing funds that usually include long term loans, bonds, debentures and preferred stock etc.

All the information required to compute capital gearing ratio is available from the balance sheet.

Example:

The following information have been taken from the balance sheet of PQR limited:

Year 2020:

- Common stockholders’ equity: $3,500,000

- Preferred stock – 9%: $1,400,000

- Bonds payable – 6%: $1,600,000

Year 2021:

- Common stockholders’ equity: $2,800,000

- Preferred stock – 9%: $1,800,000

- Bonds payable – 6%: $1,400,000

We can compute the capital gearing ratio for the years 2020 and 2021 from the above information as follows:

For the year 2020:

Capital gearing ratio = 3,500,000/3,000,000

= 7 : 6 (Low geared)

For the year 2021:

Capital gearing ratio = 2,800,000/3,200,000

= 7 : 8 (Highly geared)

The company has a low geared capital structure in 2020 and highly geared capital structure in 2021.

Notice that the gearing is inverse to the common stockholders’ equity.

- Highly geared >>> Less common stockholders’ equity

- Low geared >>> More common stockholders’ equity

Significance and interpretation:

Capital gearing ratio is the measure of capital structure analysis and financial strength of the company and is of great importance for actual and potential investors.

Borrowing is a cheap source of funds for many companies but a highly geared company is considered a risky investment by the potential investors because such a company has to pay more interest on loans and dividend on preferred stock and, therefore, may have to face problems in maintaining a good level of dividend for common stockholders during the period of low profits.

Banks and other financial institutions reluctant to give loans to companies that are already highly geared.

Leave a comment