Notes payable

Content:

Definition and explanation

The note payable is a written promissory note in which the maker of the note makes an unconditional promise to pay a certain amount of money after a certain predetermined period of time or on demand. The purpose of issuing a note payable is to obtain loan form a lender (i.e., banks or other financial institution) or buy something on credit.

The companies usually issue notes payable when they:

- purchase merchandise or raw materials inventory from suppliers.

- acquire professional services from an individual or a firm.

- purchase plant, machinery, equipment, furniture or some other fixed assets.

- obtain loan from banks or other financial institutions.

- are required to issue a note as a substitution of a past-due account payable.

The notes payable are not issued to general public or traded in the market like bonds, shares or other trading securities. They are bilateral agreements between issuing company and a financial institution or a trading partner.

Format of note payable

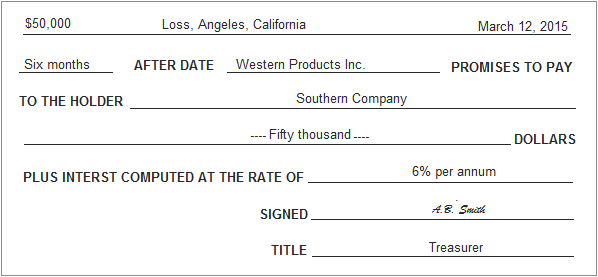

A simple format of interest-bearing note payable is given below:

The above note has been made on March 12, 2015. In this note, the Western Products Inc. is the maker of the note that makes an unconditional promise to pay Southern Company an amount of fifty thousand dollars plus 6% interest after six month of the date of preparation of the note. The note has been signed by A.B. Smith who is the treasurer of the company.

Classification of notes payable

The notes payable are usually classified in two ways. These are:

- short-term and long-term notes payable and

- interest-bearing and zero-interest-bearing notes payable.

Short-term and long-term notes payable:

(i). Short-term notes:

The short term notes payable are classified as short-term obligations of a company because their principle amount and any interest thereon is mostly repayable within one year period. They are usually issued for purchasing merchandise inventory, raw materials and/or obtaining short-term loans from banks or other financial institutions. The short-term notes may be negotiable which means that they may be transferred in favor of a third party as a mode of payment or for the settlement of a debt. The short-term notes are reported as current liabilities and their presence in balance sheet impacts the liquidity position of the business.

(ii). Long-term notes:

The long term-notes payable are classified as long term-obligations of a company because the loan obtained against them is normally repayable after one year period. They are usually issued for buying property, plant, costly equipment and/or obtaining long-term loans from banks or other financial institutions.

The long term-notes payable are very similar to bonds payable because their principle amount is due on maturity but the interest thereon is usually paid during the life of the note. On a company’s balance sheet, the long term-notes appear in long-term liabilities section.

Interest-bearing and zero-interest-bearing notes payable:

(i). Interest-bearing notes:

An interest-bearing note is a promissory note with a stated interest rate on its face. This note represents the principal amount of money that a lender lends to the borrower and on which the interest is to be accrued using the stated rate of interest.

(ii). Zero-interest-bearing notes:

A zero-interest-bearing note (also known as non-interest bearing note) is a promissory note on which the interest rate is not explicitly stated. When a zero-interest-bearing note is issued, the lender lends to the borrower an amount less than the face value of the note. At maturity, the borrower repays to lender the amount equal to face vale of the note. Thus, the difference between the face value of the note and the amount lent to the borrower represents the interest charged by the lender. In other words, we can say that the borrower receives the amount equal to the present value of the note because the present value of a financial instrument is equal to the face value of the instrument less any interest or discount charged by the lender.

Important points to remember about discount on notes payable:

- Timing of the fee or discount charged by the lender:

In case of a zero-interest-bearing note, it is clear that the lender essentially receives its fee at the time of borrowing rather than at the date of maturity. - When the discount on notes payable is to be charged to expense:

The amount of discount charged by the lender represents the cost of borrowing which must be expensed over the life of the note rather than at the time of obtaining the loan. - Impact of discount on notes payable on balance sheet:

The discount on notes payable account normally has a debit balance because it is a contra account to notes payable account (a liability account). When financial statements are prepared, the balance of discount on notes payable account is deducted from notes payable in the balance sheet.

Notes payable on balance sheet = Balance of notes payable account – Balance of discount on notes payable account

Examples

Journal entries for interest-bearing notes:

On November 1, 2018, National Company obtains a loan of $100,000 from City Bank by signing a $100,000, 6%, 3 month note. National Company prepares its financial statements on December 31, each year.

Required: For National Company, prepare:

- a journal entry required at the time of issuing the note on November 1, 2018.

- an annual adjusting entry required to accrue the interest expense on December 31, 2018.

- a journal entry required at the time of repayment of principal as well as interest on February 1, 2019.

Solution:

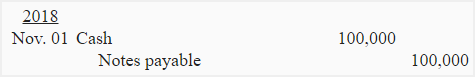

1. Journal entry at the time of issuing the note on November 1, 2018:

National Company must record the following journal entry at the time of obtaining loan and issuing note on November 1, 2018.

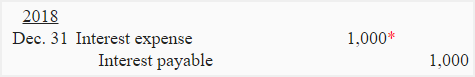

2. Adjusting journal entry required to accrue interest expense on December 31, 2018:

National Company prepares its financial statements on December 31 each year. Therefore, it must record the following adjusting entry on December 31, 2018 to recognize interest expense for 2 months (i.e., for November and December, 2018).

*100,000 × 6% × 2/12

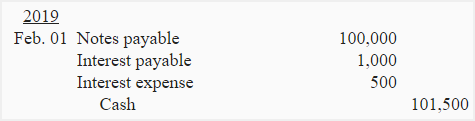

3. Journal entry at the time of repayment of loan as well as interest on February 1, 2019:

The note payable issued on November 1, 2018 matures on February 1, 2019. On this date, National Company must record the following journal entry for the payment of principal amount (i.e., $100,000) plus interest thereon (i.e., $1,000 + $500).

Journal entries for zero-interest-bearing note:

On November 1, 2018, National Company obtains a loan of $100,000 from City Bank by signing a $102,250, 3 month, zero-interest-bearing note. National Company prepares its financial statements on December 31, each year.

Required: For National Company, prepare:

- a journal entry to be made on November 1, 2018.

- an adjusting journal entry to be made on December 31, 2018.

- journal entries to be made on March 1, 2019.

Solution:

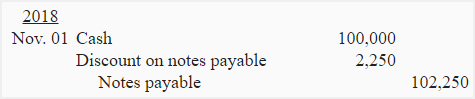

1. Journal entry at the time of issuing the note on November 1, 2018:

The company obtains a loan of $100,000 against a note with a face value of $102,250. The difference between the face value of the note and the loan obtained against it is debited to discount on notes payable.

The discount on notes payable in above entry represents the cost of obtaining a loan of $100,000 for a period of 3 months. Therefore, it should be charged to expense over the life of the note rather than at the time of obtaining the loan.

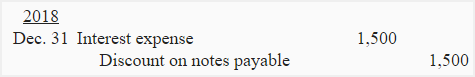

2. Adjusting journal entry required on December 31, 2018:

The company prepares its financial statements on December 31. It must charge the discount of two months to expense by making the following adjusting entry on December 31, 2018.

$2,250 × 2/3 = 1,500

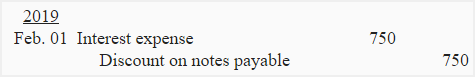

3. Journal entries on February 1, 2019:

On February 1, 2019, the company must charge the remaining balance of discount on notes payable to expense by making the following journal entry.

The following entry is required at the time of repayment of the face value of note to the lender on the date of maturity which is February 1, 2019.

Leave a comment