Working capital turnover ratio

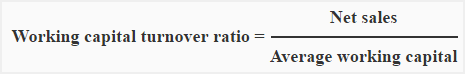

Working capital turnover ratio is computed by dividing the net sales by average working capital. It shows company’s efficiency in generating sales revenue using total working capital available in the business during a particular period of time.

Formula:

The formula consists of two components – net sales and average working capital. Net sales are equal to gross sales less any sales returned by customers during the period. Some analysts prefer to use cost of goods sold (COGS) rather than net sales as numerator of the formula. They argue that cost of goods sold has a more direct relation to the efficiency with which working capital is used in the business.

Working capital is equal to current assets minus current liabilities and average working capital is equal to working capital at the start of the period plus working capital at the end of the period divided by 2. The whole information for the computation of average working capital is available from the beginning and closing balance sheets.

Note for students: It is always preferable to use average working capital for the computation of working capital turnover ratio. However if only closing balances of current assets and current liabilities are known and beginning working capital cannot be determined, the working capital at the end of the period (closing working capital) may be used as denominator of the formula.

For more explanation consider the following example:

Example:

The following information has been extracted from Exide company:

- Net sales: $300,000

- Current assets on January 1, 2016: $240,000

- Current assets on December 31, 2016: $280,000

- Current liabilities on January 1, 2016: $140,000

- Current liabilities on December 31, 2016: $100,000

Required: Compute working capital turnover ratio of Exide from the above information.

Solution:

= $300,000/$140,000*

= 2.14

*Average working capital:

[($240,000 – $140,000) + ($280,000 – $100,000)]/2

The working capital turnover ratio of Exide company is 2.14. It means each dollar invested in working capital has contributed $2.14 towards total sales revenue.

Interpretation:

Generally, a high working capital turnover ratio is better. A low ratio indicates inefficient utilization of working capital during the period. The ratio should be compared with the previous years’ ratio, competitors’ or industry’s average ratio to have a meaningful idea of the company’s efficiency in using its working capital.

The working capital turnover ratio should be carefully interpreted because a very high ratio may also be a sign of insufficient quantity of working capital in the business.

Leave a comment