Times interest earned (TIE) ratio

Times interest earned (TIE) ratio shows how many times the annual interest expenses are covered by the net operating income (income before interest and tax) of the company. It is a long-term solvency ratio that measures the ability of a company to pay its interest charges as they become due.Times interest earned ratio is known by various names such as debt service ratio, fixed charges cover ratio and Interest coverage ratio. The ratio is expressed in times.

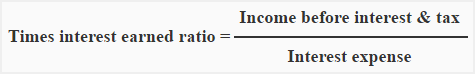

Formula:

Times interest earned ratio is computed by dividing the income before interest and tax by interest expenses. The formula is given below:

Income before interest and tax (i.e., net operating income) and interest expense figures are available from the income statement.

Example:

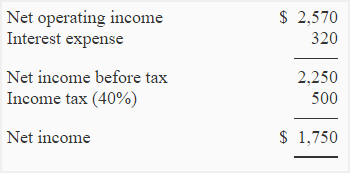

A creditor has extracted the following data from the income statement of PQR and requests you to compute and explain the times interest earned ratio for him.

Required: Compute times interest earned (TIE) ratio of PQR company.

Solution:

= (2,570 / 320)

= 8.03 times

The times interest earned ratio of PQR company is 8.03 times. It means that the interest expenses of the company are 8.03 times covered by its net operating income (income before interest and tax).

Significance and Interpretation:

Times interest earned ratio is very important from the creditors view point. A high ratio ensures a periodical interest income for lenders. The companies with weak ratio may have to face difficulties in raising funds for their operations.

Generally, a ratio of 2 or higher is considered adequate to protect the creditors’ interest in the firm. A ratio of less than 1 means the company is likely to have problems in paying interest on its borrowings.

A very high times interest ratio may be the result of the fact that the company is unnecessarily careful about its debts and is not taking full advantage of the debt facilities.

Leave a comment