Over or under-applied manufacturing overhead

The over or under-applied manufacturing overhead is defined as the difference between manufacturing overhead cost applied to work in process and manufacturing overhead cost actually incurred by the entity during the period.

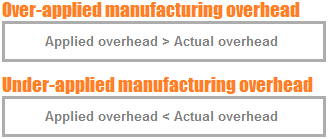

If the manufacturing overhead cost applied to work in process is more than the manufacturing overhead cost actually incurred during a period, the difference is known as over-applied manufacturing overhead. If, on the other hand, the manufacturing overhead cost applied to work in process is less than the manufacturing overhead cost actually incurred during a period, the difference is known as under-applied manufacturing overhead.

The occurrence of over or under-applied overhead is normal in manufacturing businesses because overhead is applied to work in process using a predetermined overhead rate. A predetermined overhead rate is computed at the beginning of the period using estimated information and is used to apply manufacturing overhead cost throughout the period.

The procedure of computing predetermined overhead rate and its use in applying manufacturing overhead has been described in “measuring and recording manufacturing overhead cost” article. In the rest of this article, we will discuss how over or under-applied overhead cost is handled in a manufacturing environment.

Recording actual and applied overhead cost in manufacturing overhead account:

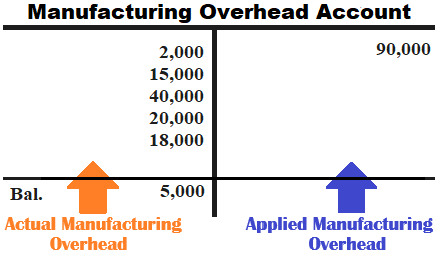

Over or under-applied manufacturing overhead is actually the debit or credit balance of an entity’s manufacturing overhead account (also known as factory overhead account).

Actual manufacturing overhead costs are debited and applied manufacturing overhead costs are credited to manufacturing overhead account. All actual overhead costs are debited as they are incurred and applied overhead costs are credited as they are applied to work in process. At the end of a period, if manufacturing overhead account shows a debit balance, it means the overhead is under-applied. On the other hand, if it shows a credit balance, it means the overhead is over-applied. For further explanation of the concept, consider the following example of manufacturing overhead account:

IN ABOVE EXAMPLE, THE OVERHEAD IS OVER-APPLIED BY $5,000

The debit or credit balance in manufacturing overhead account at the end of a month is carried forward to the next month until the end of a particular period – usually one year.

Disposition of over or under-applied manufacturing overhead:

At the end of the year, the balance in manufacturing overhead account (over or under-applied manufacturing overhead) is disposed off by either allocating it among work in process, finished goods and cost of goods sold accounts or transferring the entire amount to cost of goods sold account. These two methods have been discussed below:

Method 1: Allocation among work in process, finished goods and cost of goods sold account:

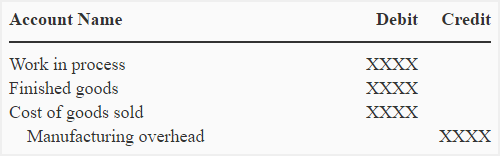

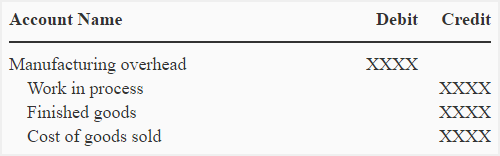

Under this method, the amount of over or under-applied overhead is disposed off by allocating it among work in process, finished goods and cost of goods sold accounts on the basis of overhead applied in each of the accounts during the period. The following journal entry is made to dispose off an over or under-applied overhead:

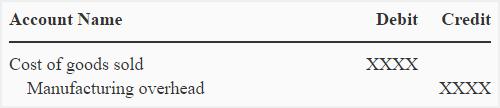

When overhead is under-applied:

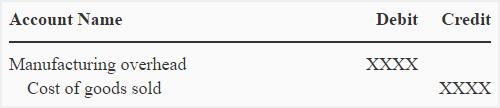

When overhead is over-applied:

This method is more accurate than the second method. The only disadvantage of this method is that it is more time consuming.

Method 2: Transferring the entire amount of over or under-applied to cost of goods sold:

Under this method the entire amount of over or under applied overhead is transferred to cost of goods sold. The following entry is made for this purpose:

When overhead is under-applied:

When overhead is over-applied:

This method is not as accurate as first method. Companies use this method because it is less time consuming and easy to use.

Example:

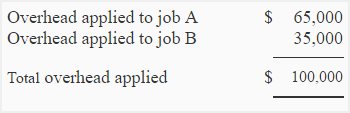

During the year 2012, Beta company started two jobs – job A and job B . Job A consisted of 1,000 units and job B consisted of 500 units. At the end of the year 2012, job A was completed but job B was in process. The information about manufacturing overhead cost applied to job A and B was as follows:

The actual manufacturing overhead cost incurred by the company during 2012 was $108,000. Out of 1,000 units in job A, 750 units had been sold before the end of 2012.

Required: Calculate over or under applied manufacturing overhead and make journal entries required to dispose off over or under applied manufacturing overhead assuming:

- It is disposed off by allocating between inventory and cost of goods sold accounts.

- It is disposed off by transferring to cost of goods sold.

Solution:

Calculation of over or under-applied manufacturing overhead:

In our example, manufacturing overhead is under-applied because actual overhead is more than applied overhead. The under-applied overhead has been calculated below:

Under-applied manufacturing overhead = Total manufacturing overhead cost actually incurred – Total manufacturing overhead applied to work in process

= $108,000 – $100,000

= $8,000

Journal entries to dispose off under-applied overhead:

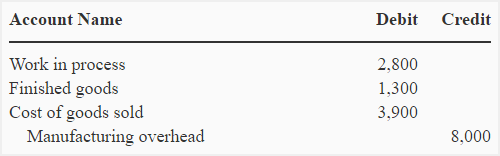

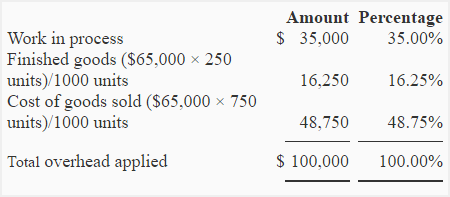

(1). Allocation of under-applied overhead among work in process, finished goods, and cost of goods sold accounts:

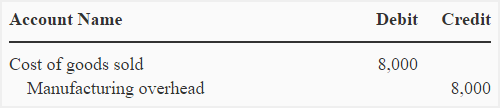

(2). Transfer of entire under-applied overhead to cost of goods sold account:

Leave a comment