No par value stock

No-par value stock, as the name implies, is a type of stock that does not have a par value attached to each of its share. Unlike par value stock, no-par value stock certificate does not have a per share value printed on it.

Although prohibited in many countries, the issuance of no-par value stock is allowed in some states of USA.

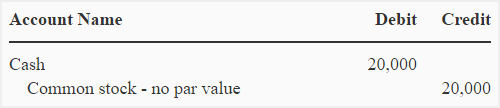

Journal entry for issuing no-par value stock:

No-par value stock is issued without discount or premium. The whole amount received as a result of issuing this type of stock is debited to cash account and credited to common or preferred stock.

Example:

The US company issues 1,000 shares of its no par value stock at $20 per share, it will record the following journal entry for this issue:

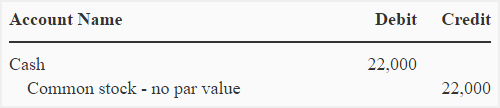

If the company issues additional 1,000 shares of its common stock at $22 per share, the journal entry will be recorded as follows:

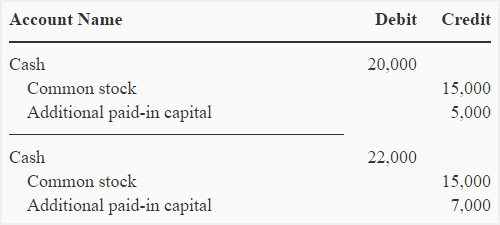

In above example, we have talked about a true no-par value stock i.e., it is carried in the accounts at issue price and there is no additional paid-in capital or discount on stock. But in some states companies are either allowed or legally required to set a minimum per share value below which the stock cannot be issued. This minimum value in such case would be the stated value. In such situations, companies have the option to carry the stock in the accounts at its issue price or stated value. Suppose, for example, the board of directors of the US company assigns a minimum value of $15 to each share of common stock, the two journal entries discussed above will be recorded as follows:

(1). If the stock is carried in the accounts at issue price:

(2). If the stock is carried at stated value assigned by the company:

Notice that the journal entries for the issuance of no-par value stock under second option are similar to that of the issuance of par value stock.

Leave a comment