Fixed assets to equity ratio

Fixed assets to equity ratio measures the contribution of stockholders and the contribution of debt sources in the fixed assets of the company. It is computed by dividing the fixed assets by the stockholders’ equity.

Other names of this ratio are fixed assets to net worth ratio and fixed assets to proprietors fund ratio.

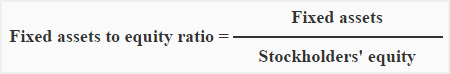

Formula:

The numerator in the above formula is the book value of fixed assets (i.e., fixed assets less depreciation) and the denominator is the stockholders’ equity that consists of common stock, preferred stock, paid in capital and retained earnings. Information about fixed assets and stockholders’ equity is available from balance sheet.

Example:

The finance manager of Bright Future Inc., wants to evaluate the long term solvency position of the company. He has extracted the following data from the financial statements of the company:

Fixed assets: $1,290,000

Accumulated depreciation: $90,000

Total stockholders’ equity: $1,500,000

Required: Compute fixed assets to stockholders’ equity ratio as a part of the long term solvency test of Bright Future Inc.

Solution:

= $1,200,000* / $1,500,000

0.8 or 80% if expressed in percentage

*1,290,000 – 90,000 = 1,200,000

The ratio is less than 1. It means that all fixed assets and a portion of working capital of Bright Future Inc., has been financed by the stockholders.

Significance and interpretation:

If fixed assets to stockholders’ equity ratio is more than 1, it means that stockholders’ equity is less than the fixed assets and the company is relying on debts to finance a portion of fixed assets. If the ratio is less than 1, it means that stockholders’ equity is more than the fixed assets and the stockholders’ equity is financing not only the fixed assets but also a part of the working capital.

Different industries have different norms for this ratio. Generally a ratio of 0.60 to 0.70 (or 60% to 70%, if expressed in percentage form) is considered satisfactory for most of the industrial undertakings.

Fixed assets to stockholders’ equity ratio is used as a complementary ratio to proprietary ratio.

Leave a comment