Average payment period

Average payment period means the average period taken by the company in making payments to its creditors. It is computed by dividing the number of working days in a year by creditors turnover ratio. Some other formulas for its computation are give below:

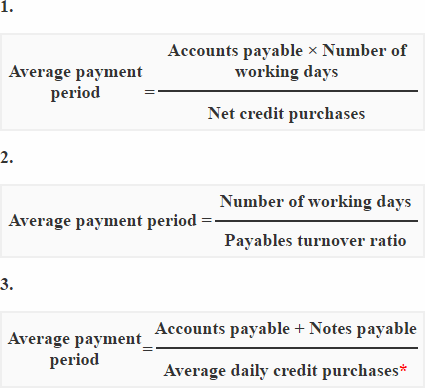

Formula:

This ratio may be computed in a number of ways:

*Average daily credit purchases = Credit purchases/Number of working days in a year

Any of the above formulas may be used to compute average payment period. If credit purchases are unknown, the total purchases may be used.

Example:

Metro trading company makes most of its purchases on credit. The extracted data for the year 2012 is given below:

- Total purchases: $570,000

- Cash purchases: $150,000

- Accounts payable at the start of the year: $65,000

- Accounts payable at the end of the year: $40,000

- Notes payable at the start of the year: $20,000

- Notes payable at the end of the year: $15,000

Required: Calculate average payment period from the above data assuming 360 days in a year.

Solution:

When complete information about credit purchases and opening and closing balances of accounts payable is given, the proper method to compute average payment period is to compute accounts payable turnover ratio first and then divide the number of working days in a year by accounts payable turnover ratio.

Accounts payable turnover ratio = $420,000*/$70,000**

= 6 times

Average payment period = 360 days/6 times

= 60 days

*Computation of net credit purchases:

= $570,000 – $150,000

= $420,000

**Computation of average accounts payable:

= [(A/R opening + N/R opening) + (A/R closing + N/R closing)] / 2

= [($65,000 + $20,000) + ($40,000 + $15,000)] / 2

= $70,000

The average payment period of Metro trading company is 60 days. It means, on average, the company takes 60 days to pay its creditors.

Significance and interpretation:

A shorter payment period indicates prompt payments to creditors. Like accounts payable turnover ratio, average payment period also indicates the creditworthiness of the company. However, a very short payment period may indicate that the company is not taking full advantage of its allowed credit terms.

Managers may try to make payments promptly to avail the discount offered by suppliers. Where a discount is offered for early payments, the benefit of discount should be compared with the benefit of the total credit period allowed by suppliers.

Leave a comment