Treatment of idle time, overtime premium, and fringe benefit costs

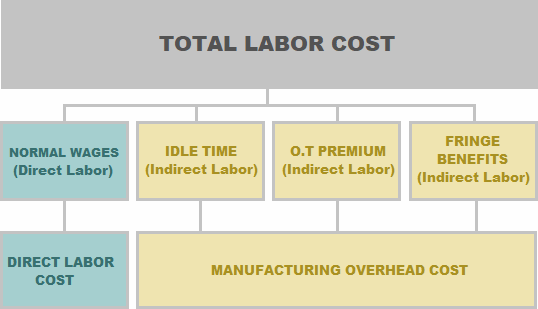

In addition to direct labor costs, there are other costs associated with direct labor workers. These are idle time, overtime premium and fringe benefits that are often provided by employers to their direct labor workers. From accounting perspective, these additional payments are not considered the part of direct labor cost but are treated otherwise. The rest of the content in this article explains the computation and accounting treatment of the cost incurred by a commercial entity in respect of idle time, overtime premium and labor fringe benefits etc.

Treatment of idle time:

Idle time means the amount of time the workers remain idle in a normal working day. The idle time is usually caused by a sudden fault in machine or equipment, power failure, lack of orders for the product, inefficient work scheduling, defective materials and shortage of raw materials etc. Any cost associated with idle time is treated as indirect labor cost and should, therefore, be included in manufacturing overhead cost.

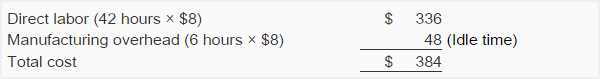

For example, the normal weekly working hours of a worker are 48 and he is paid @ $8 per hour. If he remains idle for 6 hours due to power failure or some other reason, the cost of 42 hours would be treated as direct labor cost and the cost of 6 hours, which is the idle time, would be treated as indirect labor cost and would be included in manufacturing overhead cost. The separate calculations for the two types of costs are shown below:

Treatment of overtime premium:

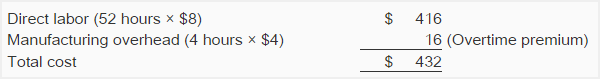

Overtime premium is the amount of remuneration that is paid to workers for the overtime worked by him, in excess of the normal wage rate. Like idle time, overtime premium is also treated as indirect labor cost and is included in entity’s manufacturing overhead cost. For example, a worker normally works for 48 hours per week @ $8 per hour. In a particular week, if he works for 52 hours and the company in which he works pays him $12 for every hour worked in excess of 48 hours in a week, the allocation of the labor cost associated with him would be made as follows:

Notice that the labor cost of $16, in above calculation, is the overtime premium because it is a part of the manufacturing overhead cost, and not the direct labor cost.

Treatment of labor fringe benefits:

Fringe benefits are the benefits that employers provide to their employees in addition to normal salaries or wages for the work done. Examples of fringe benefits include hospitalization, insurance programs, retirement plans, paid holidays and stock options etc. From accounting point of view different treatments of these costs have been observed. Many companies treat labor fringe benefits as indirect labor and, therefore, make these costs a part of their total manufacturing overhead.

However, some firms treat direct labor related fringe benefits as addition to their total direct labor cost, which is considered a more superior practice.

A SUMMARY OF CLASSIFICATION EXPLAINED ABOVE HAS BEEN EXHIBITED BELOW

Well understood but would have preferred for the calculation to be as follows:

Direct cost: 48 hours × $8 = $384

O/H cost: 4 hours × $12 = $48

Total cost : =$432