Suspense account

In the context of this chapter, a suspense account is a ledger account that is created to help bookkeepers and accountants make the trial balance temporarily agree when the accounting records for a specific period have one or more errors.

In the previous lesson, we have discussed different steps by which accounting errors can be detected and the trial balance can be made to agree. However, in spite of the verification of all books of accounts, accounting errors are sometimes not detected, and the trial balance does not agree. In such situations, the suspense account is used as a tool to temporarily make the debit and credit columns of the trial balance agree.

Making trial balance agree by creating a suspense account

The trial balance is a statement on the basis of which final accounts are prepared. We know that the final accounts can be prepared only if the debit and credit columns of the trial balance agree. If the trial balance does not agree, it is temporarily made to agree with the help of a temporary account, known as the “Suspense Account.” This is done because the preparation of final accounts cannot be delayed further. The amount of the difference between the debit and credit columns is written in the lesser column under the heading “Suspense Account.” For this purpose, a new account titled “Suspense Account” will be opened in the ledger.

Let’s take an example to understand how a suspense account works.

Example

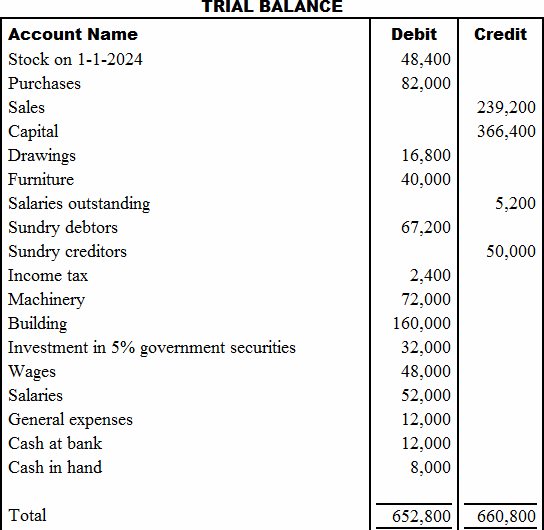

The suspense account is debited if the total of the debit column of the trial balance is short. On the other hand, the suspense account is credited if the total of the credit column is short. The following example illustrates a situation in which a disagreed trial balance has been made to agree by opening a suspense account.

Notice that there is a difference of $8,000 between the two columns of the trial balance. The debit column is short by $8,000. In spite of all the best efforts made by the bookkeeper, the errors are not detected, so the trial balance is temporarily made to agree by opening a suspense account in the ledger. The difference of $8,000 is recorded on the lesser column (debit column) of the trial balance under the heading “Suspense Account.” See the following trial balance.

*Suspense account created to make the trial balance agree.

It should be remembered that no journal entry is made when a suspense account is opened to make the debit and credit columns of the trial balance agree. The journal entries are made only when all errors are detected and rectified. These entries eliminate the impact of errors in accounting records and close the suspense account.

Students should know that the problem will not be solved by just making the trial balance agree with the help of a suspense account. This is a forced agreement, and the errors still exist in the books of accounts. A suspense account is created only to avoid the further delay in the preparation of final accounts. In the next period, the books of accounts will be thoroughly checked, errors will be detected and rectified, and the profit for the previous period will be adjusted accordingly. After all errors are detected and rectified by making journal entries, the suspense account will be closed.

In the above trial balance, the total of the debit column is $8,000 short, and a suspense account is debited with $8,000 to make the trial balance agree. Suppose a subsequent examination of accounting records disclosed that the purchase of furniture amounting to $8,000 has not been debited to the furniture account. Thus, the mistake will be rectified by passing a journal entry in which the furniture account will be debited and the suspense account will be credited. In this way, the suspense account will be closed. The suspense account in this case will look like the following:

The following journal entry will be made to rectify the error and close the suspense account:

Furniture account 8,000 [Dr]

Suspense account 8,000 [Cr]

It is useful to mention here that the extent of errors may not be necessarily assessed by the amount of the difference in the trial balance. In other words, the difference may be small in spite of the existence of major errors. Hence, the difference must not be ignored, even if it is small. For example, suppose we buy goods amounting to $20,000 but don’t debit the purchases account by mistake. At the same time, we receive cash amounting to $19,000 from a debtor but don’t credit the accounts receivable account by mistake. For these two major errors, the trial balance will show a difference of only $1,000 (= $20,000 – $19,000).

Leave a comment