Exercise-25: Internal rate of return (IRR) and net present value (NPV) methods

Learning objectives:

This problem illustrates the use of net present value (NPV) method to evaluate a capital investment with even cash flow, and the use of internal rate of return (IRR) method in a cost-cutting project.

Problem-5 (a): Net present value (NPV) method

Sunlight Company needs a machine for its manufacturing process. The cost of the machine is $80,700 with an expected useful life of 8 years. At the end of 8-year period, the machine would have no salvage value. After installation, the machine would increase cash inflows by $30,000 per year. Sunlight is interested to know the net present value of the machine to accept or reject this investment. The minimum required rate of return of the company is 16% on all capital investments.

Required:

- Compute net present value of the machine.

- Is it acceptable to purchase the machine?

Solution:

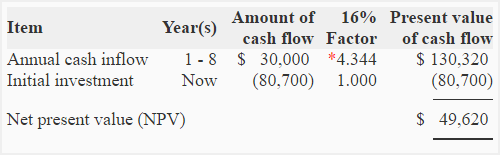

(1) Net present value computation:

* Value from “present value of annuity of $1 in arrears table“.

(2) Purchase decision:

The positive net present value (computed above) indicates that the investment is profitable, therefore the machine should be purchased.

Problem-5 (b): Internal rate of return method

A machine can reduce annual cost by $40,000. The cost of the machine is 223,000 and the useful life is 15 years with zero residual value.

Required:

- Compute internal rate of return of the machine.

- Is it an acceptable investment if cost of capital is 16%?

Solution:

(1) Internal rate of return (IRR) computation:

Internal rate of return factor = Net annual cash inflow/Investment required

= $223,000/$40,000

= 5.575

Now see internal rate of return factor (i.e., 5.575) in 15 year line of the present value of an annuity of $1 table. After finding this factor, see the corresponding interest rate written at the top of the column. It is 16%. Internal rate of return is, therefore, 16%.

(2) Conclusion:

The investment is acceptable because internal rate of return promised by the machine is equal to the cost of capital of the company.

Leave a comment