Exercise-10: Three methods of allocating joint costs

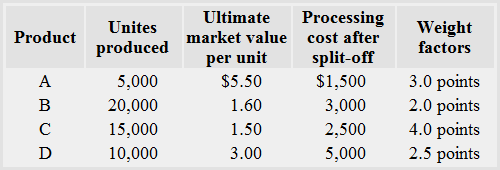

Sun Inc. produces four joint products – product A, product B, product C and product D. The joint production cost at split-off point is $70,000. The data for the month of April is given below:

Required: Allocate joint production cost using following three methods:

- The market value method

- The average unit cost method

- The weighted average method

Solution

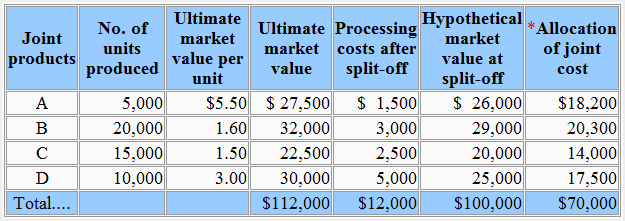

1. The market value method:

*The joint cost is 70% of the hypothetical market value. Hypothetical market value at split-off point is equal to ultimate market value less processing cost incurred after split-off point. For product A, this value is $26,500 (= $27,500 – $1,500).

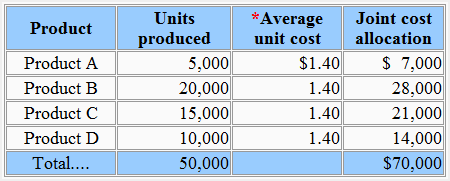

2. Average unit cost method:

*Joint cost/Total number of units produced

= $70,000/50,000

= $1.40 per unit

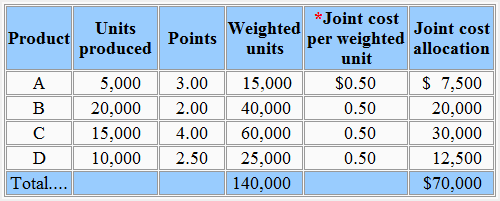

3. Weighted average method:

Under weighted average method, we need to use the weighted number of units to allocate joint cost. For this purpose, we would simply multiply the number of units produced by the weighted factors given in the problem. An appropriate format for the solution is given below:

*Joint cost/Total number of weighted units

= $70,000/140,000

= $.50 per weighted unit

Leave a comment