Monetary unit assumption

Definition and explanation

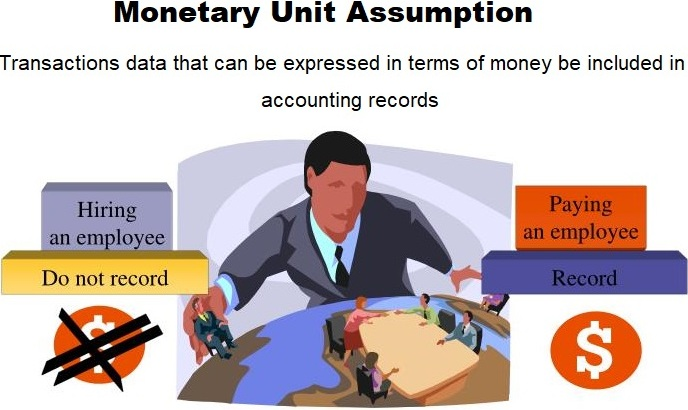

The monetary unit assumption (also known as the money measurement concept) states that only those events and transactions are recorded in the books of accounts of a business that can be measured and expressed in monetary terms. Information that cannot be expressed in terms of money is useless for financial accounting purposes and is therefore not recorded in books of accounts.

The monetary unit is a simple and universally recognized basis for communicating financial information. It is the most appropriate and effective basis for recording, communicating, and analyzing financial data on the basis of which rational business decisions can be made.

A very closely related concept to the monetary unit assumption is the stable dollar value assumption, which means that the dollar (or any other currency) does not lose its purchasing power over time. The fact that money loses its purchasing power because of inflation is ignored while recording transactions in accounting.

Examples of monetary unit assumption

Some examples of monetary unit assumption are given below:

Example 1

The CEO of Fine Enterprise delivers a lecture to the company’s employees in a special meeting. This lecture can be helpful in raising the employees’ morale and completing the current projects on time.

Since the value of the lecture cannot be expressed in terms of money, it cannot be recorded in the company’s books of accounts.

Example 2

Metro Company purchased a tract of land for $25,000 in 2005. Due to inflation in the economy, the current fair value of the land is $40,000.

Metro Company cannot adjust its balance sheet for the increase in the price of its land because the monetary unit assumption forces it to ignore the impact of inflation.

Example 3

Fast Transport Company has five trucks. One of its trucks was seriously damaged in a road accident and is being repaired.

The company can only account for the amount of insurance or any expenses that it actually has to pay to get the truck in working condition, but it cannot record the loss of revenue caused by the time the truck takes to be overhauled.

Leave a comment