Measuring and recording manufacturing overhead cost

Manufacturing costs other than direct materials and direct labor are known as manufacturing overhead or factory overhead. It usually consists of both variable and fixed components. Examples of manufacturing overhead cost include indirect materials, indirect labor, factory and plant depreciation, salary of production manager, property taxes, fuel, electricity, grease used in machines, and insurance expenses etc.

Unlike direct materials and direct labor, manufacturing overhead is an indirect cost that cannot be directly assigned to individual jobs or units of products. This problem is solved by using an allocation rate which is computed at the beginning of each period. This rate is known as predetermined overhead rate.

Application of manufacturing overhead:

As stated earlier, the predetermined overhead rate is computed at the beginning of the period and is used to apply manufacturing overhead cost to jobs throughout the period.

Manufacturing overhead cost is applied to jobs as follows:

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job

Example:

Suppose the GX company has completed a job order. The time tickets show that the workers have worked for 27 hours to complete the job. The predetermined overhead rate computed at the beginning of the year is $8 per direct labor hour. The manufacturing overhead cost would be applied to this job as follows:

Overhead applied to a particular job = Predetermined overhead rate × Amount of the allocation base incurred by the job

= $8.00 × 27 DLH

= $216

The manufacturing overhead cost assigned to the job is recorded on the job cost sheet of that particular job.

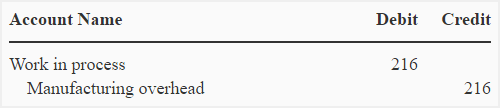

Journal entry to record manufacturing overhead cost:

The manufacturing overhead cost applied to the job is debited to work in process account. The journal entry for the application of manufacturing overhead cost computed in the above example would be made as follows:

The reason of using a predetermined overhead rate rather than actual overhead costs:

Notice that the procedure of the application of manufacturing overhead described above is based on an estimated overhead rate (i.e., predetermined overhead rate). The manufacturing overhead cost applied to the production is, therefore, not the actual overhead cost incurred by the job.

The reason of using this estimated rate is that the total actual manufacturing overhead costs are usually not known to managers before the end of the year. The application of manufacturing overhead based on a predetermined overhead rate helps in computing cost of goods sold of a particular job before it is shipped to the customer.

The use of predetermined overhead rate to apply manufacturing overhead cost to products or job orders is known as “normal cost system”.

Very helpful thank you