Exercise-8: Payback period with uneven cash flows

Learning objective:

This exercise illustrates the application of payback period technique to evaluate a proposal with uneven cash flows.

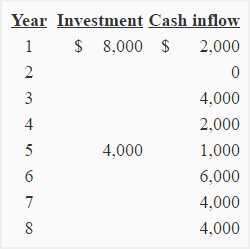

The investment and expected cash inflows of a project over its 8-year period life is given below:

Required: Compute the payback period of the project. Would the project be acceptable if the maximum desired payback period is 7 years?

Solution:

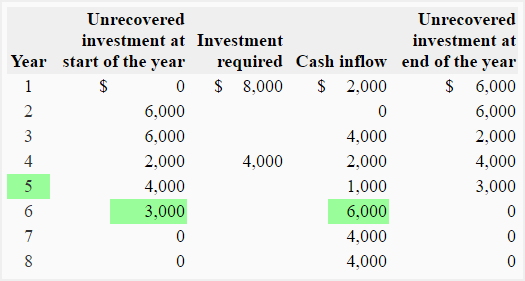

As the expected cash flows is uneven (different cash flows in different periods), the traditional payback formula cannot be used to compute payback period of this project. The payback period for this project would be computed by tracking the unrecovered investment year by year.

Payback period = years before full recovery + (Unrecovered investment at start of the year/Cash flow during the year)

= 5 + (3,000/6,000)

= 5 + 0.5

= 5.5 years or 5 years and *6 months

*0.5 × 12

The entire investment is expected to be recovered by the middle of sixth year. The payback period of this project is, therefore, 5.5 years or 5 years and six moths.

Conclusion:

The project is acceptable because payback period promised by the project is shorter than the maximum desired payback period of the management.

Leave a comment