Exercise-6: Cash received from customers – formula approach

Learning objective:

This exercise illustrates the computation of cash received from customers using the formula approach.

Exercise-6(a):

Alpha Company prepares its statement of cash flows using the direct method. It requests you to calculate the cash received from customers during the year 2023. For this purpose, the following information has been extracted from the trial balance of the company:

- Accounts receivable on December 31, 2022: $62,000

- Accounts receivable on December 31, 2023: $70,000

- Allowance for doubtful accounts on December 31, 2022: $2,100

- Allowance for doubtful accounts on December 31, 2023: $3,200

- Sales for the year 2022: $155,300

- Sales for the year 2023: $126,500

The company sells goods on credit. For the year 2023, bad debt expense was $7,500, and accounts amounting to $6,400 were written off.

Required: Compute the cash received from customers to be reported in the statement of cash flows for the year 2023.

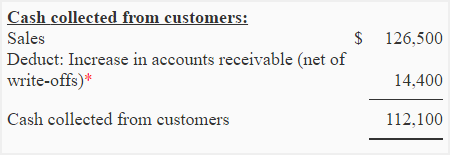

Solution:

*Closing balance of accounts receivable – (Opening balance of accounts receivable – Write-offs)

= $70,000 – ($62,000 – $6,400)

= $14,400

Note: The change in accounts receivable has been deducted from the sales because accounts receivable have increased during the period.

Exercise-6(b):

The following information belongs to Western Company:

- Accounts receivable on December 31, 2022: $90,000

- Accounts receivable on December 31, 2023: $75,000

- Allowance for doubtful accounts on December 31, 2022: $3,550

- Allowance for doubtful accounts on December 31, 2023: $4,100

- Sales for the year 2022: $225,300

- Sales for the year 2023: $346,500

The bad debt expense was $7,800, and write-offs totaled $7,250 during the year 2023. All sales are made on credit.

Required: Compute the total amount of cash received from customers by Western Company during the year 2023.

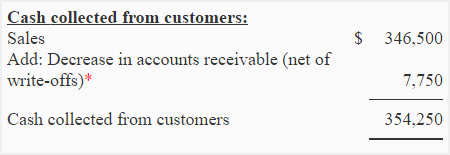

Solution:

*(Opening balance of accounts receivable- Write-offs) – Closing balance of accounts receivable

= ($90,000 – $7,250) – $75,000

= $7,750

Note: The change in accounts receivable has been added to the sales because accounts receivable have decreased during the period.

Leave a comment