Exercise-4: Joint product costing – average unit cost and market value methods

Exercise-4 (a)

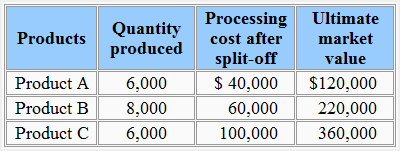

The Monster Company runs a joint production process to produce three different products. The joint production cost for July is $200,000. The information about quantity produced, ultimate market value and processing cost after split-off point for each product is given below:

Required:

- Allocate the joint production cost to each product using using average unit cost method and compute the total production cost of each product.

- Allocate the joint production cost to each product using market value method and compute the total production cost of each product.

Solution

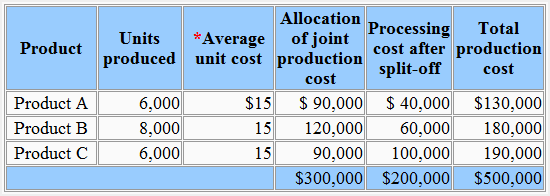

1. Average unit cost method

*Average unit cost:

Total joint cost/total number of units produced

= $300,000/20,000 units

= $15

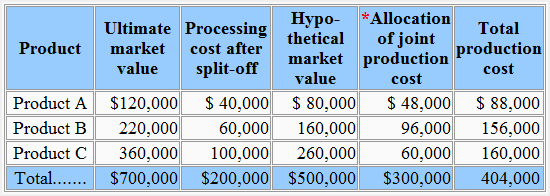

2. Market value method

*Joint production cost is 60% of hypothetical market value as computed below:

$300,000/$500,000

= 0.6 or 60%

Hypothetical market value is computed by subtracting processing cost after split-off from the ultimate market value.

Exercise-4 (b)

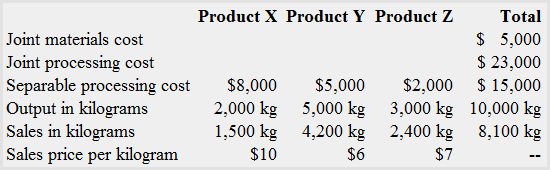

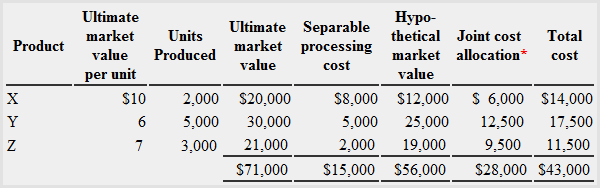

The IGI firm produces three joint products, product X, Product Y, and product Z. The following data was collected during June:

Required:

- Allocate the joint production cost to joint products using market value method and compute the total cost of each product.

- How would you justify the treatment of a joint product as by-product?

Solution

1. Allocation of joint production cost under market value method:

*The joint cost is 50% of the hypothetical market value

Hypothetical market value is equal to ultimate market value less separable processing cost.

2. Justification of the treatment of joint product as by-product:

A joint product is normally treated as a by-product if its sales value is relatively minor compared to other joint products.

Leave a comment