Exercise-17: After-tax cash flows in net present value (NPV) analysis

Learning objective:

This exercise illustrates the consideration of tax effects on cash flows and tax deductible non-cash expenses (like depreciation) while conducting a project’s net present value (NPV) analysis.

Falcon Company is considering to purchase a printing machine. The relevant information is given below:

- Cost of the printing machine: $150,000

- Annual cash inflows: $45,000

- Useful life of printing machine: 15 years

- Salvage value (Residual value) after 15-year period: $10,000

- Annual cash expenses: $5,000

Falcon company uses straight line method of depreciation. Salvage value is not taken into account for calculating depreciation for tax purposes. The tax rate of Falcon is 30% and the company requires a 14% after-tax return on all investments.

Required: Compute net present value (NPV) of the proposed printing machine.

Solution:

Let’s solve the exercise in three steps.

Step 1 – Calculate net annual cash inflows:

Net annual cash inflow = Annual cash inflow – Annual cash expenses

= $45,000 – $5,000

= $40,000

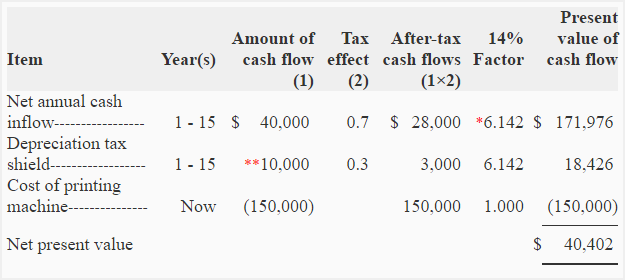

Step 2 – Calculate the net present value:

*Value from “present value of an annuity of $1 in arrears table“:

14% interest rate, 15 periods.

**Tax savings from depreciation tax shield – depreciation is a tax deductible non-cash expense.

NPV decision

The printing machine has a positive net present value (NPV) of $40,402 which makes it an acceptable investment.

Leave a comment