Exercise 1: Computation of equivalent units under weighted average and FIFO method

Learning objective:

This exercise illustrates the computation of equivalent units of production under both the weighted average and the FIFO method.

Exercise 1 (a):

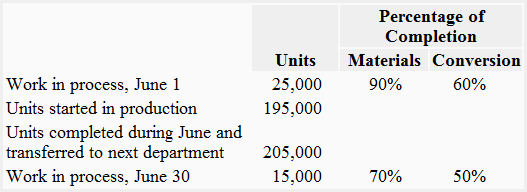

Mexico Company manufactures a single product that goes through two departments. The data relating to activity performed in the first department during the month of June is given below:

Required: Compute the equivalent units of production assuming the company uses:

- a weighted average method.

- a FIFO method.

Solution

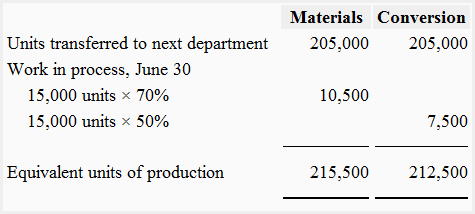

1. Equivalent units of production under weighted average method:

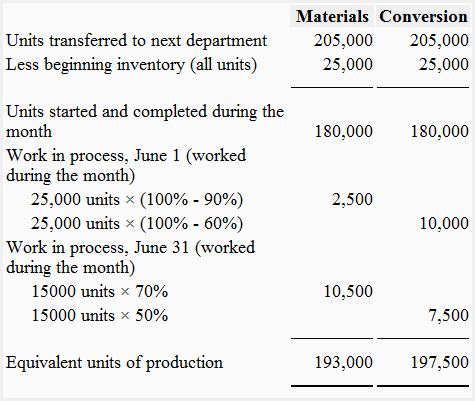

2. Equivalent units of production under FIFO method:

Exercise 1 (b):

The following data belongs to three different independent situations:

- Situation 1:

Started in process: 26,000 units

Transferred out: 22,000 units

Work in process ending inventory: 1,600 units 1/2 completed and 2,400 units 1/4 completed - Situation 2:

Work in process beginning inventory: 25,000 units, 2/5 completed

Started in process: 100,000 units

Transferred out: 105,000 units

Work in process ending inventory: 12,000 units 1/2 completed and 8,000 units 1/4 completed - Situation 3:

Work in process beginning inventory: 18,000 units 1/3 completed and 12,000 units 1/2 completed

Started in process: 75,000 units

Transferred out: 90,000 units

Work in process ending inventory: 6,000 units 1/2 completed and 9,000 units 1/3 completed

Units transferred out are 100% complete with respect to all cost elements. The stages of completion mentioned for beginning and ending inventories are applicable to all cost elements.

Required: Compute the equivalent production in each of the above situations using:

- the weighted average costing method.

- the FIFO costing method.

Solution

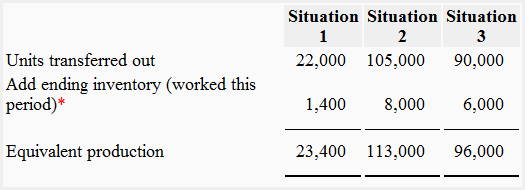

1. Equivalent production under weighted average method:

*Equivalent units in ending inventory:

The equivalent units in work-in-process ending inventory consist of the percentage of work done in the current period. The computations of equivalent units in work-in-process ending inventory for all three situations are given below:

Situation 1:

= (1600 units × 1/2) + (2400 units × 1/4)

= 800 units + 600 units

= 1,400 units

Situation 2:

= (12,000 units × 1/2) + (8,000 units × 1/4)

= 6,000 units + 2,000 units

= 8,000 units

Situation 3:

= (6,000 units × 1/2) + (9000 units × 1/3)

= 3,000 units + 3,000 units

= 6,000 units

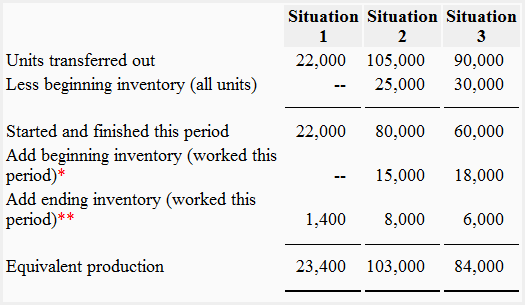

2. Equivalent production under FIFO method

*Equivalent units in beginning inventory:

The equivalent units in work-in-process beginning inventory consist of the percentage of work done in the current period. The computations of equivalent units in work-in-process beginning inventory for all three situations are given below:

Situation 1:

There is no beginning inventory in situation 1.

Situation 2:

= 25,000 units × 3/5

= 15,000 units

Situation 3:

= (18,000 units × 2/3) + (12,000 units × 1/2)

= 12,000 units + 6,000 units

= 18,000 units

**Equivalent units in ending inventory:

The equivalent units in work-in-process ending inventory consist of the percentage of work done in the current period. The computations of equivalent units in work-in-process ending inventory for the FIFO method are the same as under the weighted average method.

Situation 1:

= (1600 units × 1/2) + (2400 units × 1/4)

= 800 units + 600 units

= 1,400 units

Situation 2:

= (12,000 units × 1/2) + (8,000 units × 1/4)

= 6,000 units + 2,000 units

= 8,000 units

Situation 3:

= (6,000 units × 1/2) + (9000 units × 1/3)

= 3,000 units + 3,000 units

= 6,000 units

Thanks. very useful contents