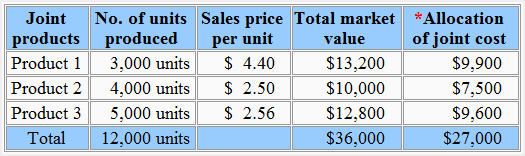

Exercise-1: Joint cost allocation – market value method

Exercise-1 (a)

Master Company manufactures three products – product 1, product 2 and product 3. The production data of three products for the month of January 2019 is given below:

- Product 1: 3,000 units

- Product 2: 4,000 units

- Product 3: 5,000 units

The sales prices or market values at split-off point are given below:

- Product 1: $4.40

- Product 2: $2.50

- Product 3: $2.56

During January 2019, Master Company incurred a total joint production cost of $27,000.

Required: Allocate the joint production cost among joint products using market value method.

Solution

*Allocation of joint cost:

The joint cost is 75% of total market value ($27,000/$36,000 = 0.75 or 75%)

- Product 1: $13,200 × 0.75 = $9,900

- Product 2: $10,000 × 0.75 = $7,500

- Product 3: $12,800 × 0.75 = $9,600

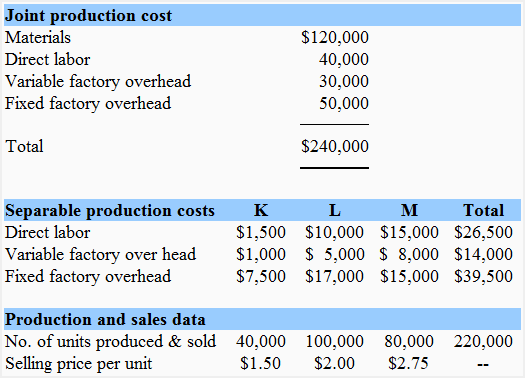

Exercise-1 (b)

Sam & Gibs Company processes a single raw material to produce three different products – product K, product L and product M. After split-off point, all three products require a further processing before they can be placed in salable condition. A summary of cost, production and sale for the year 2019 is given below:

There was no finished goods and work-in-process inventory at the start and end of the year 2019.

Required: Allocate the joint production cost to all three products and compute the gross profit of each product.

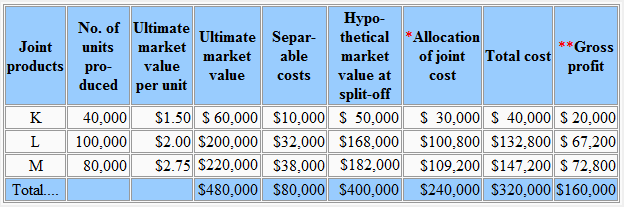

Solution

*Allocation of joint cost:

The joint production cost ($240,000) is 60% of the hypothetical market value ($400,000). The allocation has been made as follows:

- Product K: $50,000 × 0.6 = $30,000

- Product L: $168,000 × 0.6 = $100,800

- Product M: $182,000 × 0.6 = $109,200

**Gross profit

The gross profit is equal to ultimate market value less total cost.

- Product K: $60,000 – $40,000 = $20,000

- Product L: $200,000 – $132,800 = $67,200

- Product M: $220,000 – $147,200 = $72,800

Leave a comment