Comparability concept of accounting

Definition and explanation

The comparability concept of accounting states that the users of financial reports must be able to compare these reports with previous years’ reports as well as with reports of other entities dealing in the same industry.

The comparability concept suggests that financial reports must be prepared under the same accounting principles and methods each year. If a transaction requires subjectivity, it must be dealt with in the same consistent manner every year.

Comparability is achieved when an entity follows the same accounting rules that are followed by others operating within the industry. International financial reporting standards (IFRS) and generally accepted accounting principles (GAAPs) are the universally accepted accounting frameworks. Some companies implement these standards as they are, while others make necessary modifications according to the specific regulations of their countries. This ensures that companies around the world prepare their annual reports according to the same accounting rules and principles, which makes it possible for investors and other stakeholders to compare the performance and financial position of different businesses around the globe.

Examples:

- The IAS 16 (International Accounting Standard for Property, Plant and Equipment) suggests that the land or building held for use in business must be valued either on cost basis (original value) or revaluation basis (market value). After choosing the basis for valuation, the company cannot do cherry picking and will have to value all the land and buildings according to the selected basis. Additionally, the business cannot change the basis of valuation according to their suitability. For example for three consistent years the company valued its buildings and land on cost basis, and in forth year they changed the valuation to revaluation basis, just to show a better picture of the balance sheet, and then again valued property, plant and equipment on cost basis in the fifth year. This is against the comparability concept of accounting and is therefore not allowed.

- The IFRS 16 (International Financial Reporting Standard for Leases) suggests that if a company is paying lease rentals under an operating lease arrangement, these lease rentals must be expensed out in profit and loss statement.

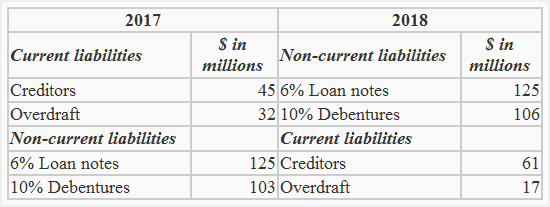

- The comparability concept also applies to the formats of financial reports. The IAS 1 (International Accounting Standard for “Presentation of Financial Statements”) guides about formats in which the financial statements must be prepared. For example:

The presentation of liabilities is different in both years, which is not appropriate as it does not ensure comparability of financial reports/statements.

Leave a comment