Closing entries

Definition and explanation

Closing entries may be defined as journal entries made at the end of an accounting period to transfer the balances of various temporary ledger accounts to one or more permanent ledger accounts.

Temporary accounts (also known as nominal accounts) are those ledger accounts that are used to record transactions for only a single accounting period and that are closed at the end of the period by making appropriate closing entries. In the next accounting period, these temporary accounts are opened again and normally start with a zero balance. In a general financial accounting system, temporary or nominal accounts include revenue, expense, dividend, and income summary accounts.

Permanent accounts (also known as real accounts) are those ledger accounts whose balance continues to exist beyond the current accounting period (i.e., these accounts are not closed at the end of the period). In the next accounting period, these accounts usually (but not always) start with a non-zero balance. All balance sheet accounts are examples of permanent or real accounts.

The permanent account to which the balances of all temporary accounts are closed is the retained earnings account in the case of a company and the owner’s capital account in the case of a sole proprietorship.

Process of preparing closing entries

The preparation of closing entries is a simple four-step process, which is briefly explained below:

Step 1 – closing the revenue accounts:

Transfer the balances of all revenue accounts to the income summary account. It is done by debiting various revenue accounts and crediting the income summary account. This closing entry looks like the following:

Various revenue accounts [Dr]

Income summary account [Cr]

This step initially closes all revenue accounts to the income summary account, which is further closed to the retained earnings account in step 3 below.

Step 2 – closing the expense accounts:

Transfer the balances of various expense accounts to the income summary account. It is done by debiting the income summary account and crediting various expense accounts. The closing entry for this is given below:

Income summary account [Dr]

Various expense accounts [Cr]

This step initially closes all expense accounts to the income summary account, which is finally closed to the retained earnings account in the next step.

Step 3 – closing the income summary account:

After the closing entries under steps 1 and 2 have been made, the income summary account will show either a credit or debit balance, which is transferred to the retained earnings account to close the income summary account. The income summary account will have a credit balance if the total of the balances of all revenue accounts is greater than the total of the balances of all expense accounts. If, on the other hand, the total of the balances of all revenue accounts is less than the total of the balances of all expense accounts, the income summary account will show a debit balance. The journal entry to close the income summary account is made as follows:

(i). Closing entry for profit:

If the income summary account has a credit balance, it means the business has earned a profit during the period and increased its retained earnings. The income summary account is, therefore, closed by debiting the income summary account and crediting the retained earnings account.

Income summary [Dr]

Retained earnings [Cr]

The above entry increases the balance of retained earnings account.

(ii). Closing entry for loss:

If the income summary account has a debit balance, it means the business has suffered a loss during the period and decreased its retained earnings. In such a situation, the income summary account is closed by debiting the retained earnings account and crediting the income summary account.

Retained earnings [Dr]

Income summary [Cr]

The above entry decreases the balance of retained earnings account.

Step 4 – closing the dividends account:

Transfer the balance of the dividends account directly to the retained earnings account. Dividends paid to stockholders is not a business expense and is, therefore, not used while determining net income or net loss. Its balance is not transferred to the income summary account but is directly transferred to the retained earnings account by making the following closing entry:

Retained earnings account [Dr]

Dividends [Cr]

With the completion of step 4, the necessary closing entries are completed, and all temporary accounts (i.e., revenue, expense, dividend, and income summary) are closed to a permanent account (i.e., retained earnings account).

Consider the following example for a better understanding of closing entries:

Example

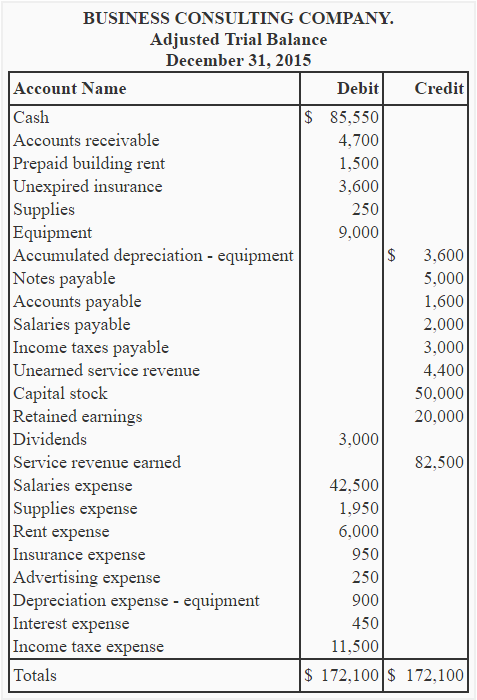

Business Consulting Company, which closes its accounts at the end of the year, provides you with the following adjusted trial balance as of December 31, 2015.

Required: Using the above trial balance, prepare the closing entries required on December 31, 2015.

Solution

*82,500 – 64,500

In our example, the income summary account has a credit balance because the balance of the service revenue earned account ($82,500) is greater than the total of the balances of all eight expense accounts ($64,500).

IT IS VERY GOOD FOR ME IWANT TO GET MORE KNOWLEDGE

It has been decades since I’ve worked in a small business, or had an accounting class. This site has very clear info, and great links to particular info as I prepare to file taxes for my own new small business.

Thank you for your help!!!

Nice explanation