Balance sheet of non-trading concerns

The basic principles for preparing the balance sheet of non-trading concerns are same as of trading concerns. The balance sheet of non-trading concerns may be prepared either in the order of permanence or in the order of liquidity. Some specific items that usually become the part of the balance sheet of non-profit organizations have been discussed here.

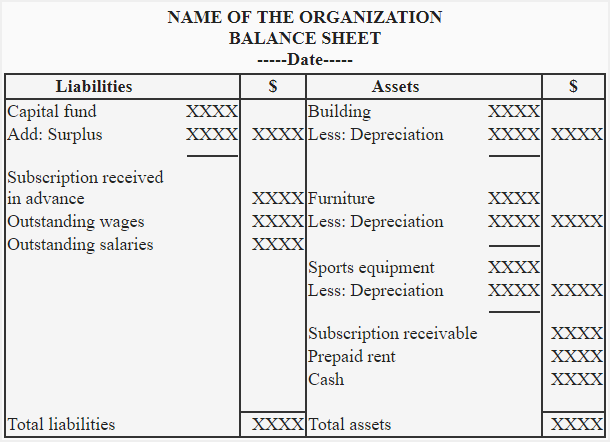

Format

A simple format/specimen of balance sheet of non-profit organization is given below:

Notice that the sample balance sheet of non-trading concerns given above is similar to that of trading concerns with the exception of capital fund in place of owner’s capital or owner’s equity. This sample only presents the format and does not depict the complete list of items that should appear on the balance sheet of a non trading concern. The items appearing on an actual balance sheet of a non-trading concern may be more or less than the items in above sample.

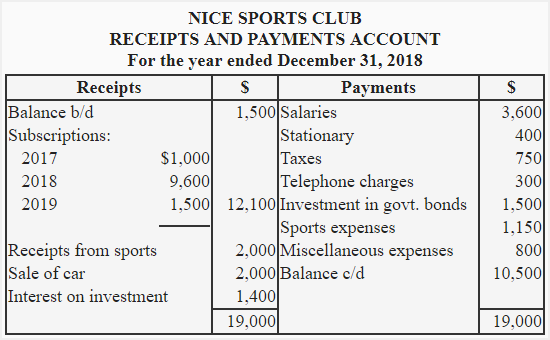

Example – preparation of balance sheet from receipts and payments account and some additional information

The receipts and payments account of Nice Sports Club for the year 2018 is given below:

You are also provided with the following additional information:

- Subscription amounting to $360 was outstanding on December 31, 2018.

- The taxes for the first three months of the year 2019 were paid in advance.

- The telephone expenses amounting to $75 were outstanding on December 31, 2018.

- The miscellaneous expenses amounting to $100 were outstanding on December 31, 2017.

- The value of investment was $18,500 on December 31, 2017.

- The stock of stationary was $250 on December 31, 2017 and $190 on December 31, 2018.

- On December 31, 2017, the book value of building and motor car was $20,000 and $2,500 respectively.

- The depreciation @ 5% is to be provided on the book value of the building.

- The club sold its car at a loss of $500 during the year. No depreciation is to be provided on car.

Required: Using above information, prepare an income and expenditure account for the year ended 2018 and a balance sheet as on December 31, 2018.

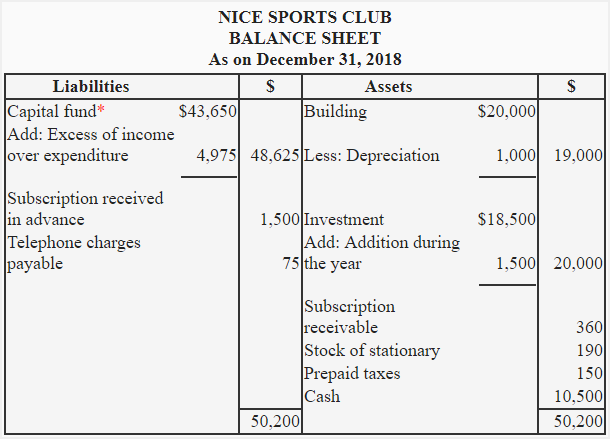

Solution

W/1:

Stationary expense for the the year = Opening balance of stationary + Stationary purchased during the year – Closing balance of stationary

= $250 + $400 – $190

=$460

W/2:

Tax expenses for the year = Taxes paid – Taxes paid in advance

= $750 – $150*

*Advance payment of taxes:

The taxes have been paid for fifteen months ( i.e., for current year as well as for first three months of the next year).

($750/15) × 3

W/3:

Telephone charges = Telephone charges paid + Telephone charges outstanding

= $300 + $75

= 375

W/4:

Miscellaneous expenses = Miscellaneous expenses paid during the year – Miscellaneous expenses for the last year

= $800 – $100

= $700

*Computation of capital fund:

Capital fund = Assets at the beginning of the year – Liabilities at the beginning of the year

= (Building + Car + Investment + Subscription receivable + Stock of stationary + Cash) – (Miscellaneous expenses payable)

= ($20,000 + $2,500 + $18,500 + $1,000 + $250 + 1,500) – ($100)

= $43,650

Very interested

Is a pleasure reading it