Relevant and irrelevant costs

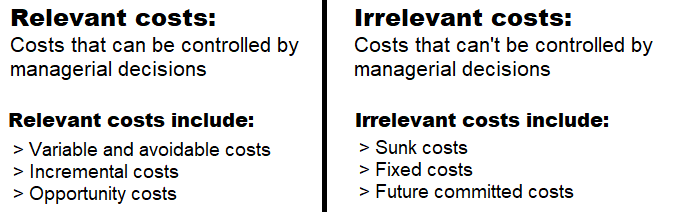

In commercial entities, the cost accounting is a prominent aspect for internal control and decision making. Some of its salient functions are identification and application of various types of costs as well as controlling and managing those costs. These managerial functions often require the bifurcation of costs into various categories. We have already discussed different categories of costs in current chapter – classification of costs. In this article, we would talk about relevant and irrelevant costs – another classification which is based on whether or not a cost can be controlled or affected through managerial decisions. Let’s explain and exemplify both the types one by one.

Relevant costs

Relevant costs are those costs which call for specific management decision and action. These are the costs that can be planned to be either incurred or avoided. They thus are the result of specific management decisions and can be controlled, affected or avoided by decisions as well. In a business environment, relevant costs may take the following forms:

- Variable or avoidable costs – the costs that will only be incurred when the decision to undertake a specific activity is taken. These costs have a direct one to one relation with an increase or decrease of activity. Examples include the use of direct materials and supplies, direct labor hired on hourly rate and variable overheads like gas, electricity and water in processing plants etc.

- Incremental costs – additional costs which are incurred towards a specific additional activity.

- Opportunity cost – the costs of losing an income or economic benefit caused by choosing one option over another.

Examples of relevant costs:

CPT Inc., a manufacturing company, is considering to add a new product line to its factory (10,000 new model shoes). The Inc. has mapped the following costs that will be needed to incept the new product line:

- Material A: 5,000 sheets of leather @ $10 per sheet.

- Material B: 10,000 shoelaces (out of which 6,000 excess are already in stock with a resale value of $0.25 per lace). Balance will need to be purchased @ $0.5 per lace.

- Skilled labor: Skilled engineering workers are needed; 10,000 man hours @ $5 per hour.

(4,000 man hours already recruited and retained in excess in existing product line). - Unskilled labor: Packing workers; 2,500 man hours are needed at $2 per hour. No workers already exist for this purpose.

- Electricity: Will include $10,000 annual fixed charges under the head of line rent and $1 per unit of electricity consumed.

- Rent: New product line will use spare 1,000 sq. ft in existing factory of 10,000 sq. ft. which has annual rent of $100,000.

The relevant costs in the above example are:

- Material A: $50,000 variable cost.

- Material B: $1,500 opportunity cost and $2,000 incremental cost.

- Skilled labor: $30,000 incremental cost only.

- Unskilled labor: $5,000 variable cost.

- Electricity: $1 per unit variable cost.

- Rent: No incremental or opportunity cost.

Irrelevant costs

Irrelevant costs, as the name implies, are those costs that are not considered in management decision making. Logically, these costs tend to be unavoidable and therefore cannot be altered or eliminated by any reasonable managerial decision. Irrelevant costs may take the following forms:

- Sunk costs – the costs that have already been incurred and no recovery of them is expected. They thus will have no bearing on management decision making. For example, research and development costs incurred in a particular area or for a specific purpose, costs of an outdated equipment that no longer can be used etc.

- Fixed costs – the costs that generally comprise of overheads that must be incurred irrespective of activity type and activity levels. For example, monthly rent of factory or office building, fixed line rent portion of utility bills, fixed periodic charges of using a facility, machine or equipment etc.

- Committed future costs – the costs which an entity has already undertaken for a legal obligation i.e., they must be paid in the future. For example, in many situations, annual maintenance charges for processing plants are paid irrespective of their usage during the period.

Examples of irrelevant costs:

Continuing the above practical example, the irrelevant costs for the decision of starting a new line of production are:

- Material A and Material B: No irrelevant cost

- Skilled labor: $20,000 has already been incurred by existing line and hence can’t be avoided, altered or changed. It is therefore irrelevant cost.

- Unskilled labor: No irrelevant cost.

- Electricity: Annual line rent of $10,000 is irrelevant as it is fixed overhead.

- Rent: Entire cost of $100,000 is irrelevant as it is an annual fixed overhead.

Conclusion

The classification of costs as relevant and irrelevant is of great importance in cost and profitability analysis, especially when management has to choose between alternatives.

In context of business decisions, the relevancy of a cost depends on its nature in a particular situation. If the nature of a particular cost allows managers to control, avoid or impact its quantum in reference to a particular business activity, the cost would be categorized as relevant, and otherwise irrelevant. In above example of CPT Inc., the list of costs has been classified on the basis of this concept.

The students need to remember that the relevancy of a cost is seen only in relation to certain activities or decisions. For example, a cost which is relevant in respect of a particular activity or decision may turn out to be irrelevant for another one. Hence, the exercise of identifying relevant and irrelevant costs needs to be done afresh every time a new decision or activity is considered.

Leave a comment