First-in, first-out (FIFO) method in periodic inventory system

Under first-in, first-out (FIFO) method, the costs are chronologically charged to cost of goods sold (COGS) i.e., the first costs incurred are first costs charged to cost of goods sold (COGS). This article explains the use of first-in, first-out (FIFO) method in a periodic inventory system. If you want to read about its use in a perpetual inventory system, read “first-in, first-out (FIFO) method in perpetual inventory system” article.

In a periodic inventory system when a sale is made, the entry to record the cost of goods sold is not made. At the end of accounting period, the quantity of inventory on hand (ending inventory) is found by a physical count and if the FIFO method is used to compute the cost of ending inventory, the cost of most recent purchases are used. Once the cost of ending inventory has been computed, the cost of goods sold can be computed easily using the following simple formula:

Cost of goods sold (COGS) = Beginning inventory + Purchases – Ending inventory

The following example illustrates the use of FIFO method in a periodic inventory system:

Example:

The Sunshine company uses periodic inventory system. The company makes a physical count at the end of each accounting period to find the number of units in ending inventory. The company then applies first-in, first-out (FIFO) method to compute the cost of ending inventory.

The information about the inventory balance at the beginning and purchases made during the year 2016 are given below:

- Mar. 01: Beginning balance; 400 units @ $18 per unit.

- Mar. 12: Purchases; 600 units @ $20 per unit.

- Oct. 17: Purchases; 800 units @ $22 per unit.

- Dec. 15: Purchases; 200 units @ $24 per unit.

On 31st December 2016, 600 units are on hand according to physical count.

Required: Compute the following using first-in, first-out (FIFO) method:

- Cost of ending inventory at 31 December 2016.

- Cost of goods sold during the year 2016.

Solution:

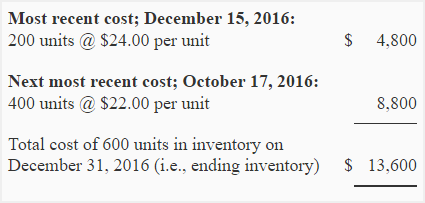

(1). Cost of ending inventory – FIFO method:

If FIFO method is used, the units remaining in the inventory represent the most recent costs incurred to purchase the inventory. The cost of 600 units on 31 December would, therefore, be computed as follows:

(2). Cost of goods sold – FIFO method

Cost of goods sold can be computed by using either periodic inventory formula method or earliest cost method.

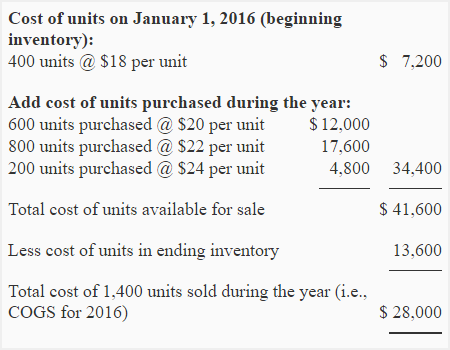

a. Formula method: Under formula method, the cost of goods sold would be computed as follows:

Cost of goods sold = Cost of units in beginning inventory + Cost of units purchased during the period – Cost of units in ending inventory

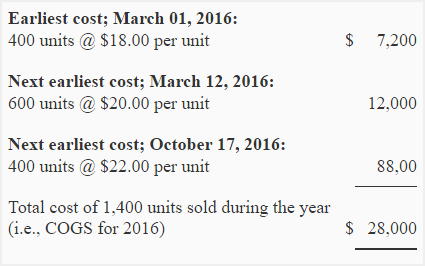

b. Earliest cost method: Under earliest cost method, we would find the total number of units sold during the period and then we would calculate the cost of these units using earliest costs.

Number of units sold = Beginning inventory + Purchases – Ending inventory

= 400 units + 1,600* units – 600 units

= 1,400 units

*600 + 800 + 200

The 1,400 units sold during the year would be costed using earliest costs as follows:

The periodic inventory and FIFO concepts can also be applied for recording and valuing direct materials in manufacturing companies. To understand their use in a manufacturing company, consider the following example:

Example:

The Galaxy manufacturing company has provided the following information about beginning balance and purchases of direct material for the year 2016:

- 01 Jan: Beginning balance; 2,800 units @ $9.20 per units.

- 15 Apr: Purchases; 2,000 units @ $9.50 per units.

- 20 Aug: Purchases; 2,500 units @ $9.80 per units.

- 15 Nov: Purchases; 1,000 units @ $10.20 per units.

At the end of the year 2016, the company makes a physical measure of material and finds that 1,700 units of material is on hand.

Required:

- Compute the cost of materials on hand at the end of the year.

- Also compute the cost of materials issued to production during the year.

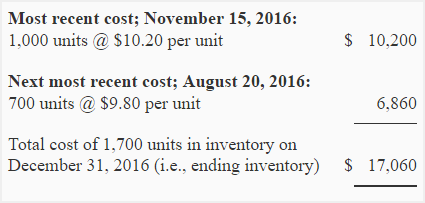

(1). Cost of materials on hand at the end of the year – FIFO method:

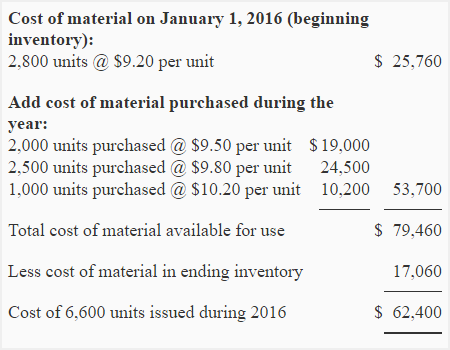

(2). Cost of materials issued for production during the year – FIFO method:

a. Formula method:

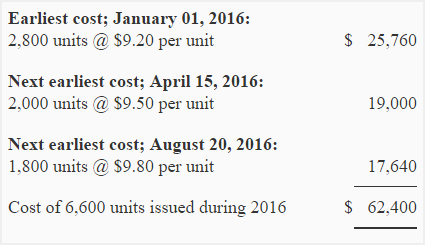

b. Earliest cost method:

Number of units issued = Units in beginning inventory + Units purchased during the period – Units in ending inventory

= 2,800 units + 5,500* units – 1,700 units

= 6,600 units

*2,000 + 2,500 + 1,000

Your page is very important for students and lecturers.

This was very helpful as I am a student.